President Trump announced Wednesday that he supported the House approach of “one big beautiful bill” to enact his tax and spending cuts. The House will now move forward with a vote on their package next week. Enactment of the proposal would have profound effects on millions of Americans as well as on our fiscal position.

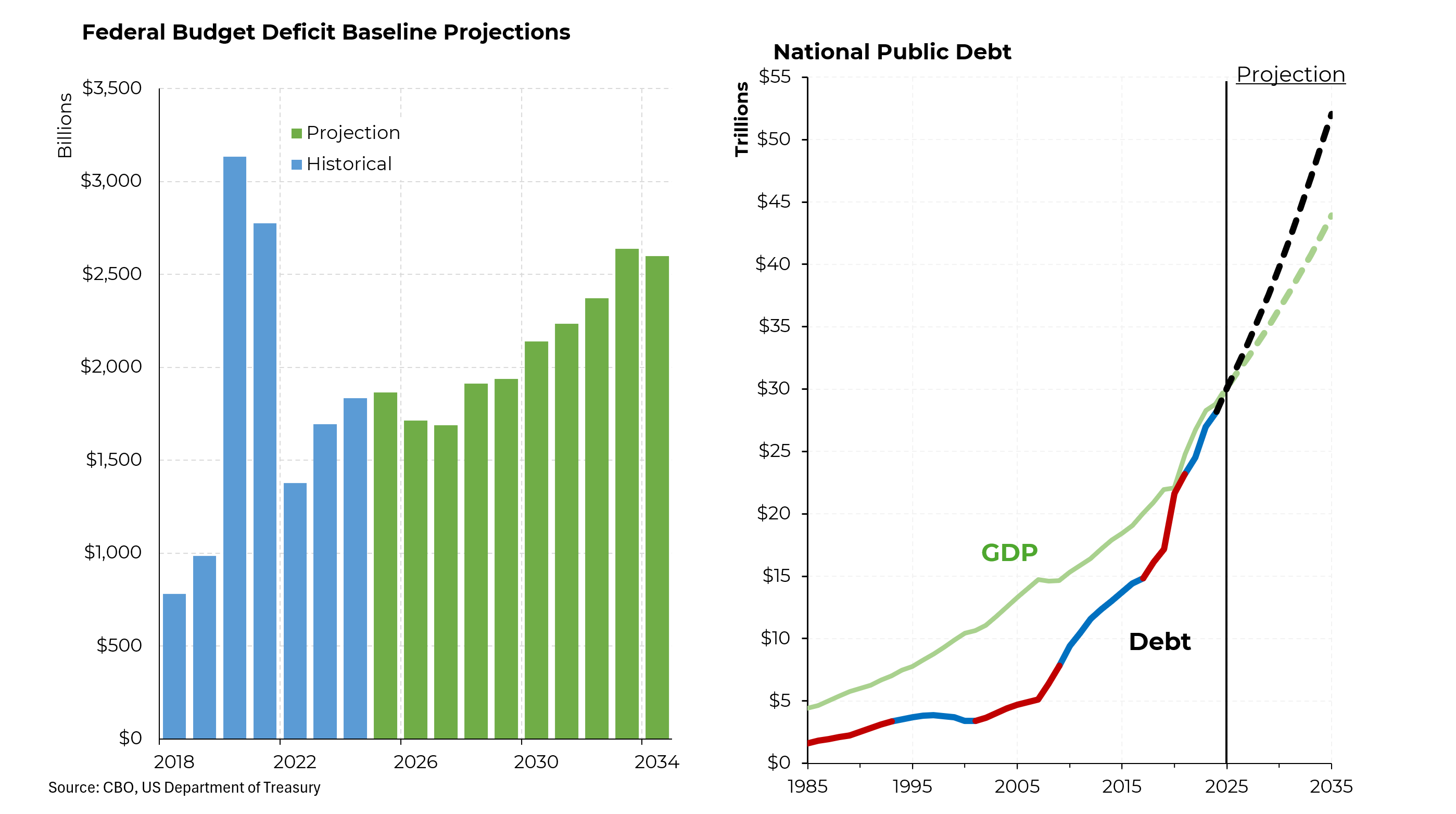

Let’s start by establishing a baseline. Our deficit has been on an almost relentless upward move for many years. It was, of course, understandable that we would need to spend more during the Covid period but even after that emergency passed, our deficit never got back to 2019 levels. And now Congressional Budget Office projections calculate that it will continue to rise, more or less relentlessly, reaching $2.6 trillion by 2034. Almost any economist would say that running substantial deficits during recessions can be advisable but incurring them at a time of low unemployment and steady growth is ill advised.

Not surprisingly, the large deficits have added to our mounting debt pile. Over the past 40 years, $14.6 trillion a year has been added by Republican presidents and $12.1 trillion by Democratic presidents. Next year, for the first time in our history with the exception of World War II, our debt level is expected to exceed 100% of our gross domestic product. And it is projected to continue to rise. This will create huge interest burdens for coming generations (and is part of why interest rates remain higher than in almost any other developed country).

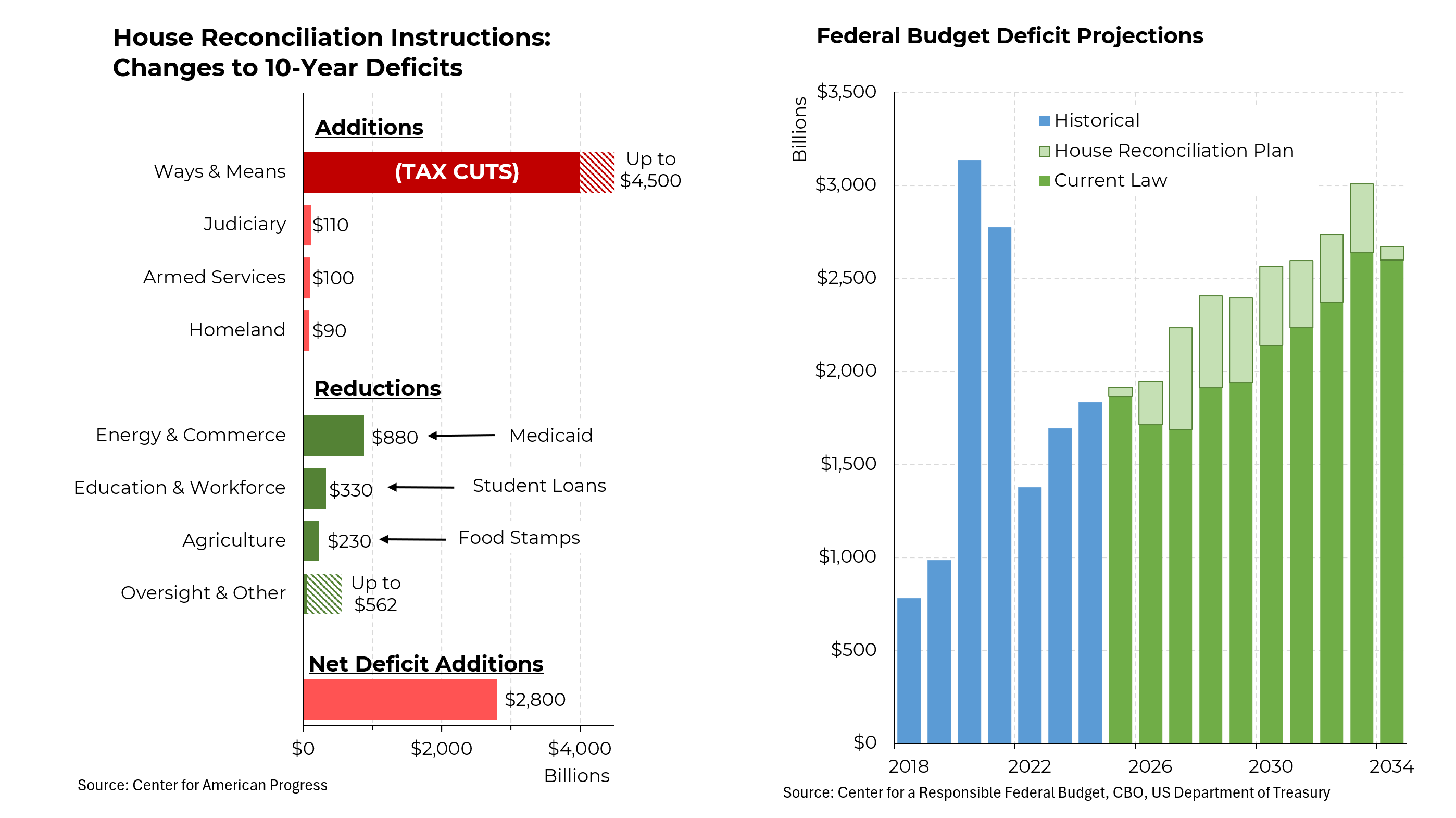

Last week, the House Budget Committee approved an overall target for fiscal changes that over the coming decade, would cut taxes by $4.5 trillion and reduce planned spending by $2 trillion, along with some other small changes, add $2.8 trillion to our debt. Apart from the tax cuts, the committee also agreed to more spending on defense and border security. Meanwhile, it targets almost $900 billion in reductions from the Energy & Commerce Committee, much of which is expected to come from Medicaid, as well as $330 billion from Education & Workforce (e.g., student loans), and $230 billion from Agriculture (think food stamps). Another $500 billion in cuts have yet to be specified.

The additions to the deficit would bring the gap in 2033 almost back to where it was during Covid. (Note that the deficit would likely not go down in 2034 – this is an accounting gimmick.) Expect to see some Republicans argue that these numbers are too pessimistic, that the tax cuts will pay for themselves. They promised that in 2017 and it never came to pass.

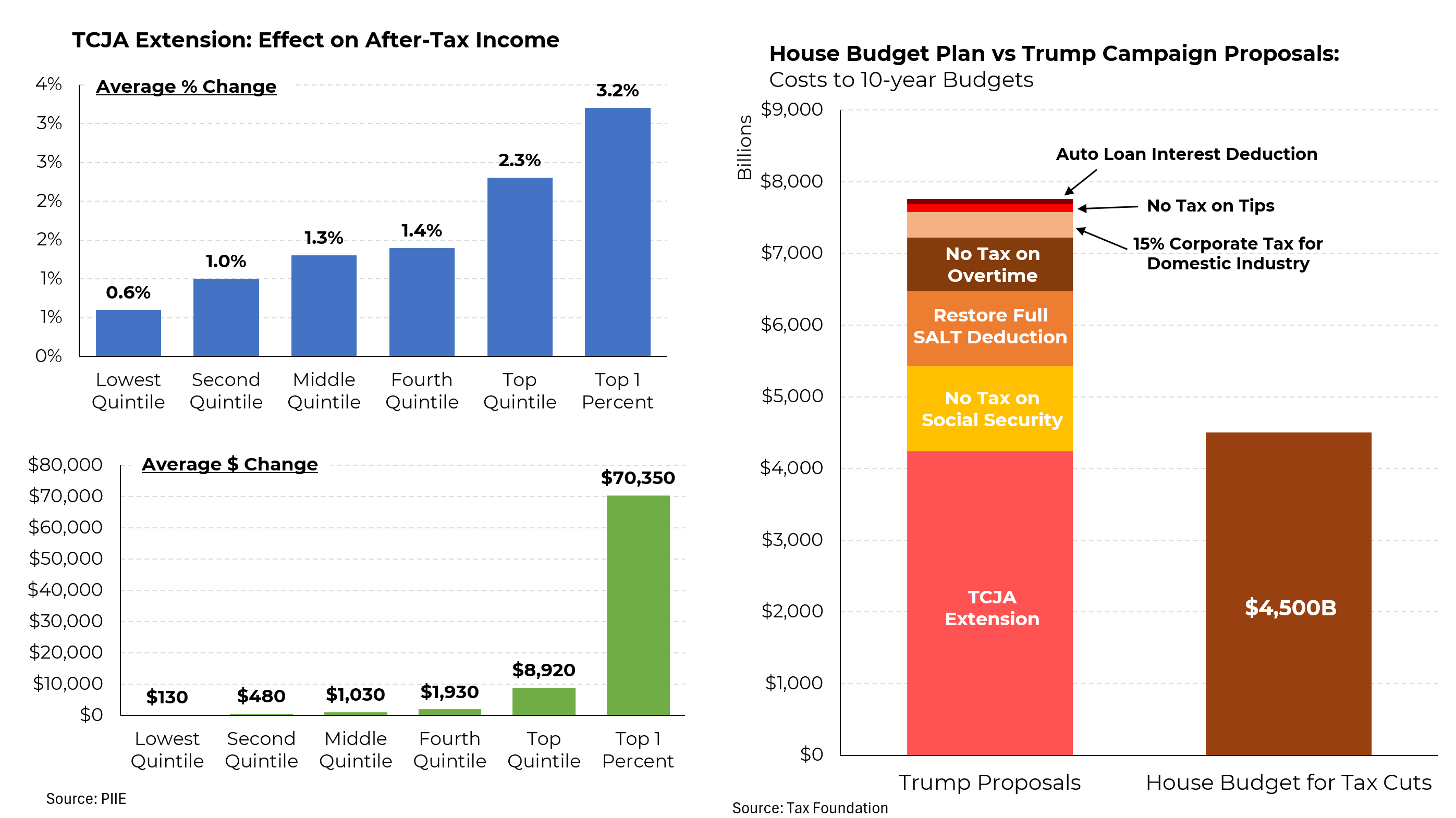

While the spending reductions have yet to be detailed, we know the potential impact of the extension of the tax cuts passed in 2017 — and it is hardly fair. Americans at or near the lower end of the income spectrum would see their after-tax incomes rise by 1.4% or less. For a middle-class household, that adds up to just over $1,000 a year. Meanwhile, a taxpayer in the top 1% would enjoy a 3.2% cut, an average of more than $70,000 for this group.

An interesting challenge for the Ways and Means Committee will be how to reconcile the $4.5 trillion limit on tax cuts with all the promises that President Trump made during the campaign — no taxes on Social Security receipts, a full restoration of state and local tax deductions, no taxes on overtime pay or tips and others. These total nearly $8 trillion. A prediction: Most of these campaign promises will end up being jettisoned.