Kamala Harris’s standing with voters on issues around the economy has been improving in recent days. It’s hard to know with any precision what accounts for that but perhaps the soundness of her economic proposals relative to those of Donald Trump has been playing a role. Just yesterday (Wednesday), 23 Nobel economists released a letter backing Harris.

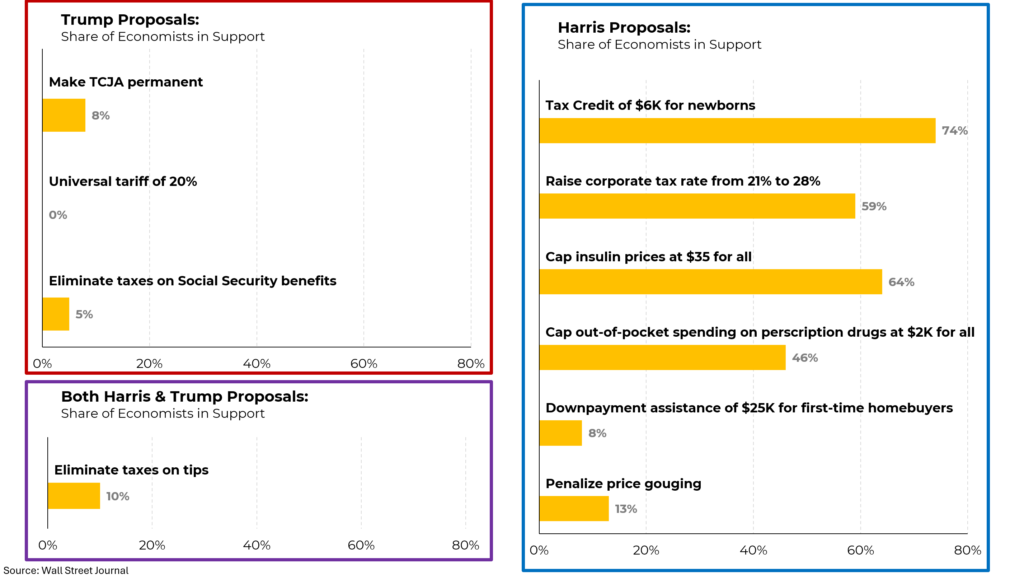

Here’s one measurement tool: a survey by The Wall Street Journal of 39 academic economists found an overall clear preference for the Harris plans. Her proposal for a $6,000 tax credit for newborns won 74% approval, her plan to increase the corporate tax rate was favored by 59%, and the concept of capping insulin prices at $35 for all garnered the support of 64%. (Capping out-of-pocket spending on all prescription drugs was essentially a tie.)

In contrast, only 8% favored making Trump’s tax cuts permanent, not a single economist favored his tariff plan, and just 5% supported eliminating taxes on Social Security benefits.

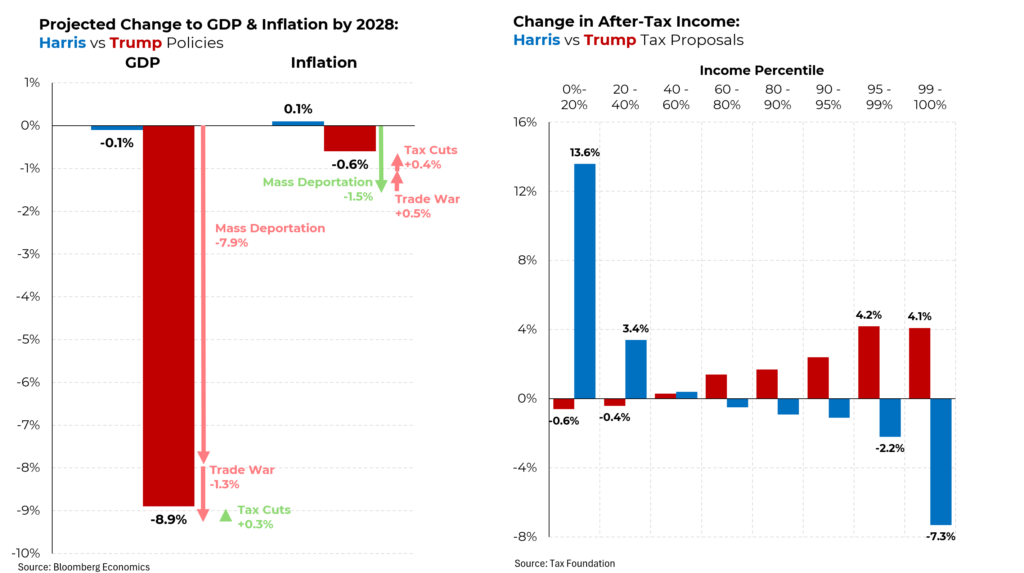

Why do economists so clearly favor Harris’s policies? A study by Bloomberg Economics found that Trump’s plan for mass deportations and large-scale tariffs would reduce the gross domestic product by 8.9%. To put that in perspective, during the financial crisis, GDP fell by 4% from peak to trough. A downturn of that size would reduce the inflation rate but that’s hardly a good exchange. (Harris’s plans would have a negligible effect on GDP and inflation.)

The two candidates’ tax plans would also have vastly different impacts. The Harris plan would sharply increase after-tax incomes for those at the bottom while lowering them for the wealthiest Americans. (This estimate does not include her proposal to extend the TCJA for those making less than $400,000 per year, which would further increase disposable income for those making less than that amount.) The Trump plan, on the other hand, would increase disposable income more, in percentage terms, for those at the top and even reduce spending power for those near the bottom.

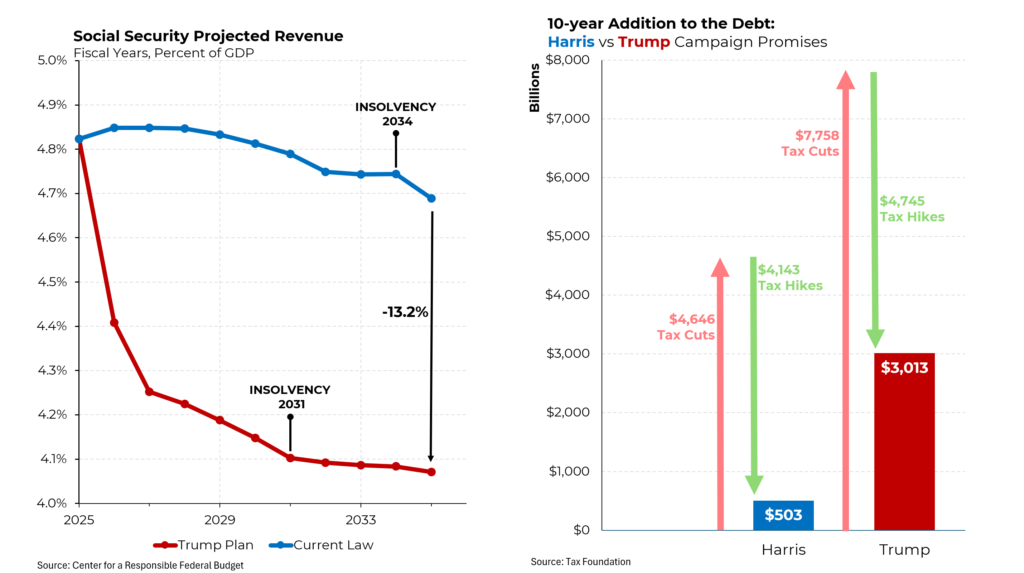

Then there’s the fiscal impact of the two plans. For starters, Trump’s plan to stop taxing Social Security benefits would sharply reduce revenues into the Social Security trust fund and accelerate the looming insolvency of the fund by three years. (Approximately $94 billion of revenue is collected each year from taxes on Social Security benefits.)

That’s just one piece of the adverse budgetary impact. The Tax Foundation has calculated that the Trump plan would add more than $3 trillion to the deficit and therefore, to the debt over the next ten years. On the other hand, the Harris plan balances tax cuts with tax increases, resulting in only a minimal increase to the national debt (above what is already projected to occur).