As hoped, the Federal Reserve announced Wednesday that it would reduce its target interest rate by 0.5% in a signal that the central bank was shifting its focus from fighting inflation to providing a small spur to an economy that appears to be slowing modestly. Importantly, the Fed renewed its expectation that the economy is likely to escape recession, a remarkable achievement given the Fed’s aggressive fight against inflation.

Pretty much the only suspense around the Fed’s regularly scheduled meeting was whether the central bank would reduce interest rates by 0.25% or 0.5%. In recent days, the chatter has pointed toward the larger reduction and so there was little reaction in the stock market after the announcement. At 0.5%, this was an unusually large first cut in what is expected to be a pattern of rate reductions, but contrary to what Donald Trump claimed, it had nothing to do with politics — the decision was approved almost unanimously by the 12 members of the Federal Open Market Committee, who represent a diversity of backgrounds and views.

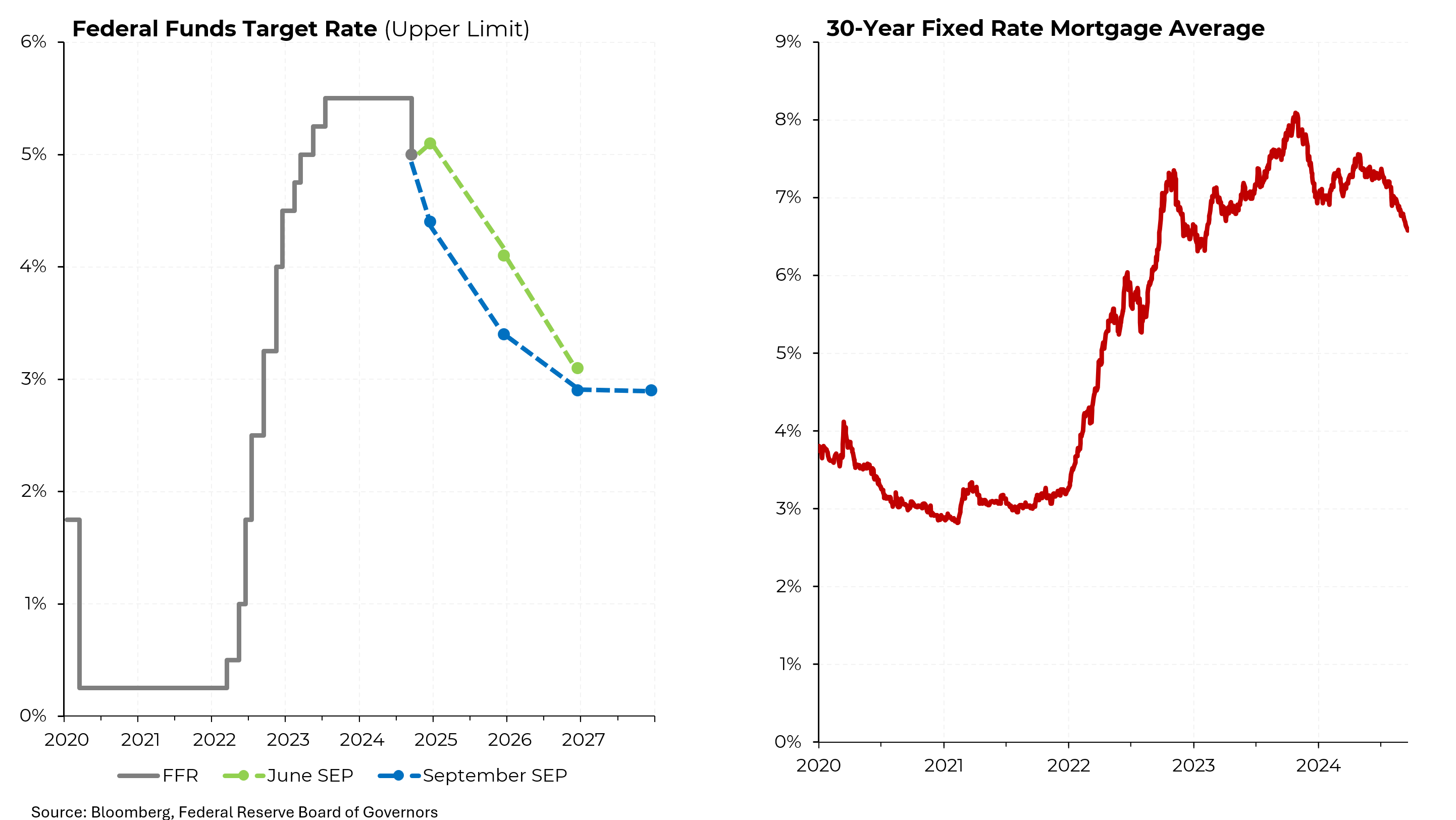

In its new projections, the Fed also expects rates to decline faster than it projected in June, when it issued its last forecast.

The related good news on interest rates is that for somewhat complex reasons, mortgage rates had already peaked and begun to decline. This will be welcomed by homeowners and prospective buyers looking to refinance their mortgages. As the Fed continues to cut the rates it controls, these costs should continue to decline.

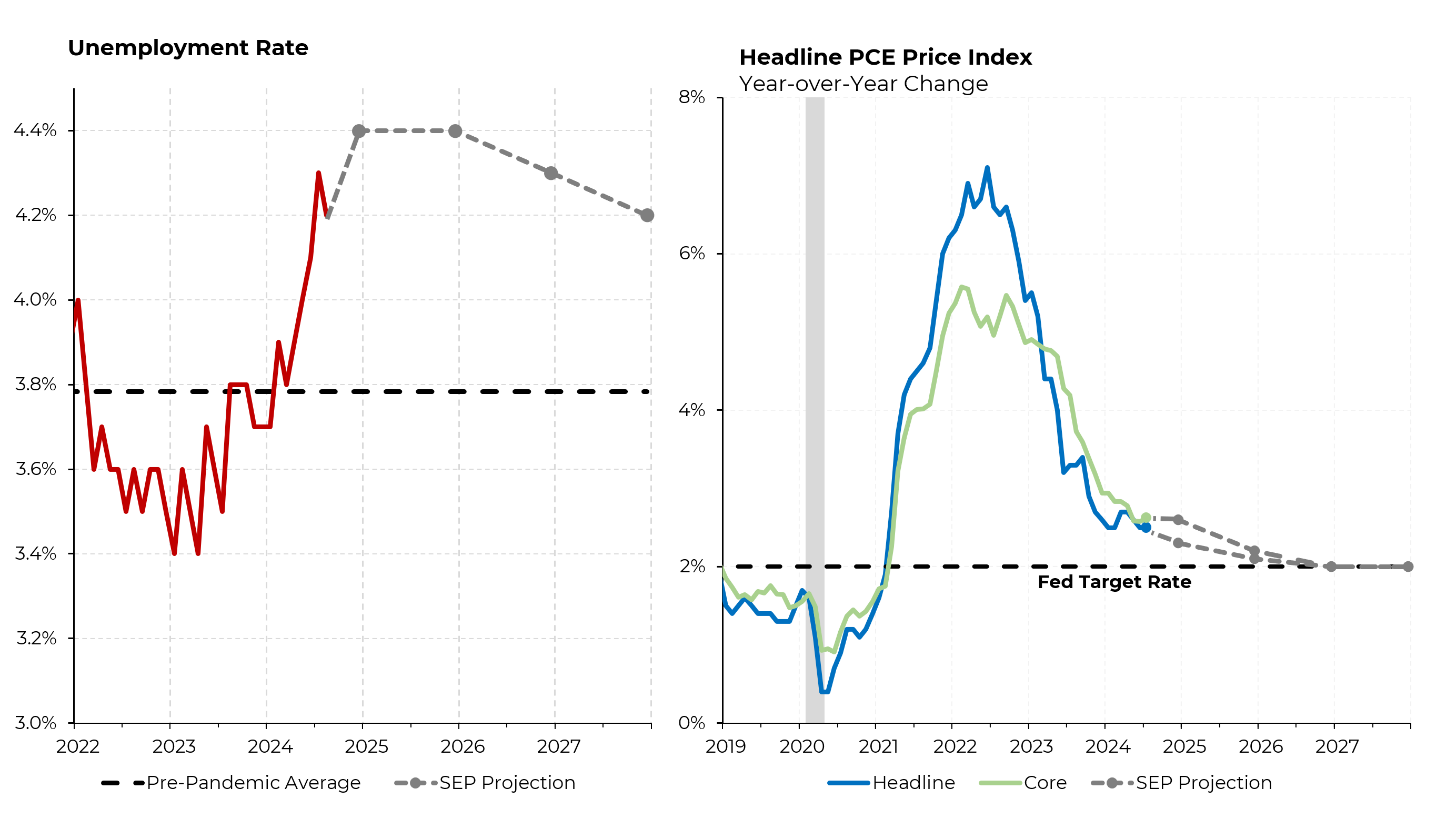

Why did the Fed move so aggressively? Two reasons. First, because the jobs picture has begun to show some signs of softening. The monthly new jobs additions have been trending down modestly and the unemployment rate has risen to 4.2% from a low of 3.4% in April of last year. (Note that 4.2% is still considered a low jobless rate.) The Fed expects the unemployment rate to peak at 4.4%.

And secondly, the Fed had the scope to move because the inflation rate has fallen precipitously. The central bank’s preferred measure is down to 2.6%, just above the 2% target. The Fed expects the rate of price increase to continue to drift down and reach its 2% target by the end of 2027.

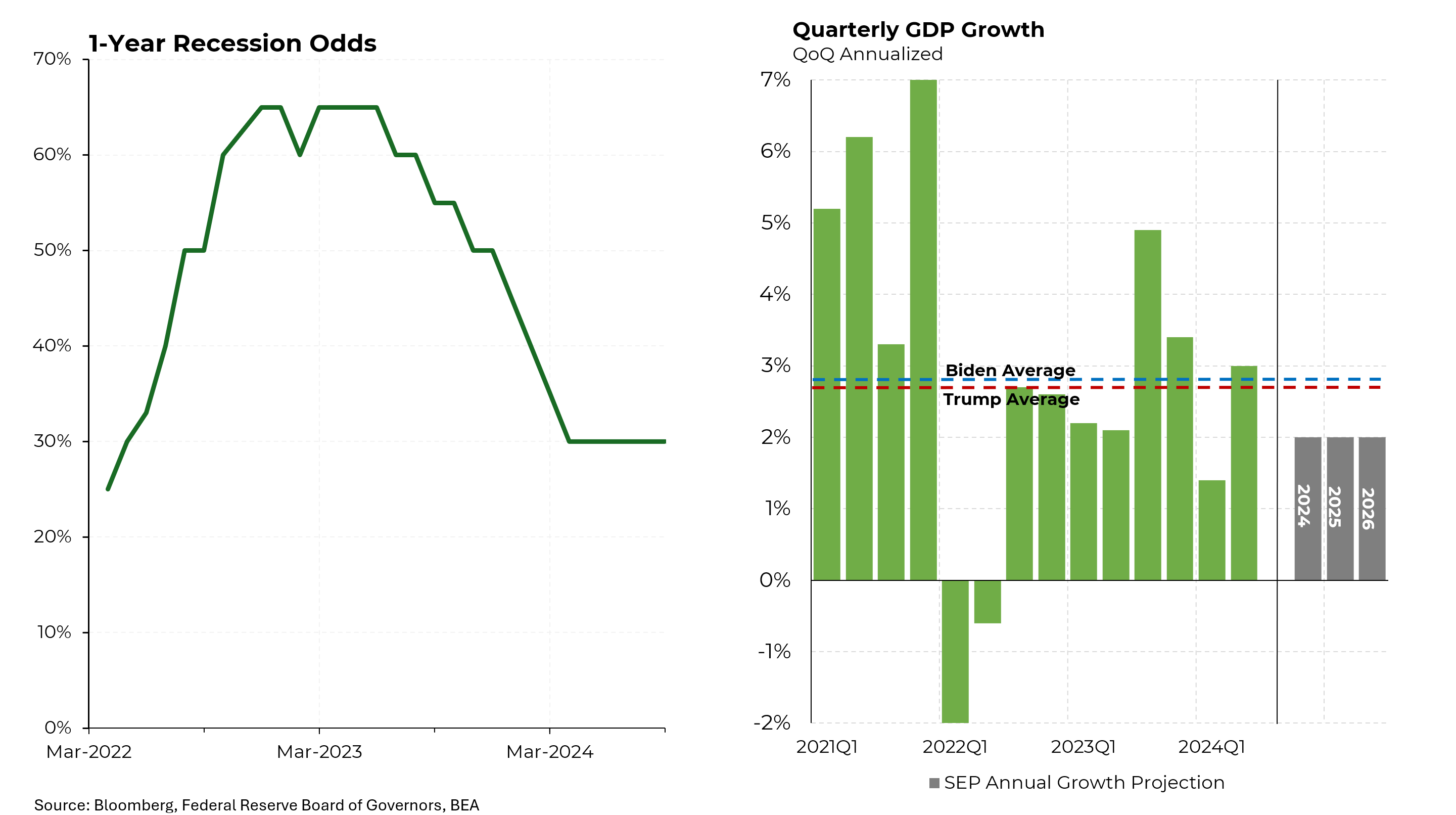

All of this has unusually and remarkably been achieved without sending the economy into a recession, an adjustment with few historical precedents. As recently as 15 months ago, 65% of economists surveyed by Bloomberg believed that a recession would likely occur in the ensuing year. Now that percentage is down to just 30%, not a guarantee of a soft landing but a hopeful sign.

Consequently, the Fed expects the recent average rate of economic growth of roughly 2% to continue through the end of 2027. Notably, and in contrast to what Trump has contended, the economy has expanded slightly faster under Joe Biden than it did under Trump, even when Covid effects are taken out.