With Donald Trump now officially nominated for a third run at the presidency, attention has turned to what a second Trump administration would actually do. Characteristically, Mr. Trump has been both vague and contradictory about his agenda but one clue lies in Project 2025, a 920-page policy manifesto produced by the ultra-conservative Heritage Foundation. While Mr. Trump has tried to distance himself from the tome, its authors include dozens of former (and potentially future) Trump administration members.

Here are three of its proposals, together with their projected impact:

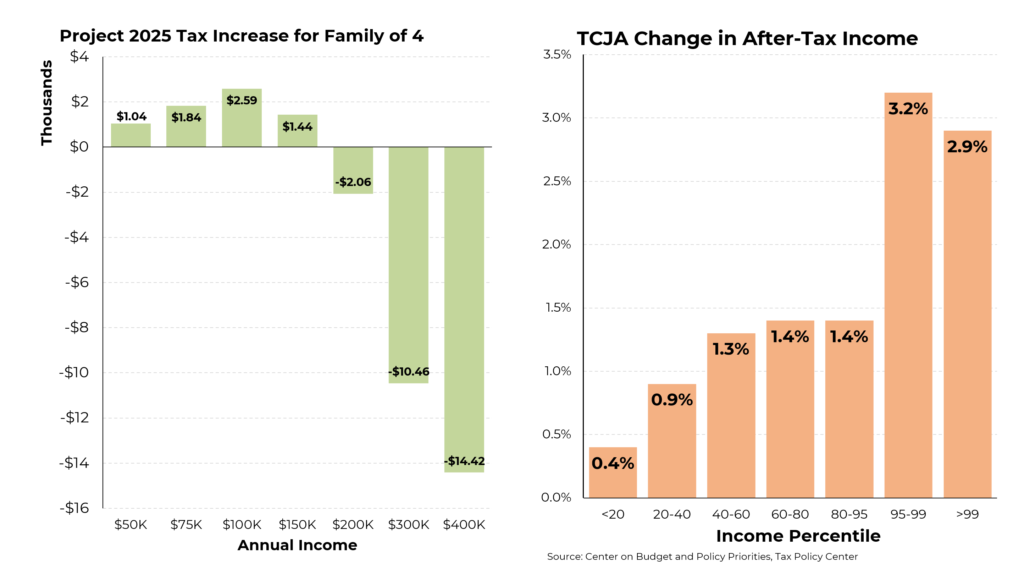

The plan would transform our current income tax system into one with just two brackets: a 15% rate and a 30% rate. The first would apply to Americans earning less than the Social Security cutoff (roughly $168,600 for single adults) and the second for those earning above those limits. This would have dramatically different effects on different individuals and families. Families of four with incomes below approximately $150,000 would see their taxes rise while those earning more would get tax cuts, potentially nearly $15,000 for those earning $400,000 a year.

That is even more regressive than Mr. Trump’s last tax package, the Tax Cut and Jobs Act, 85% of whose benefits went to corporations and Americans earning more than $75,000 a year. Moreover, the highest earning Americans received a larger proportionate tax reduction than those at the bottom, with around a 3% increase in after-tax earnings for those in the top 5%.

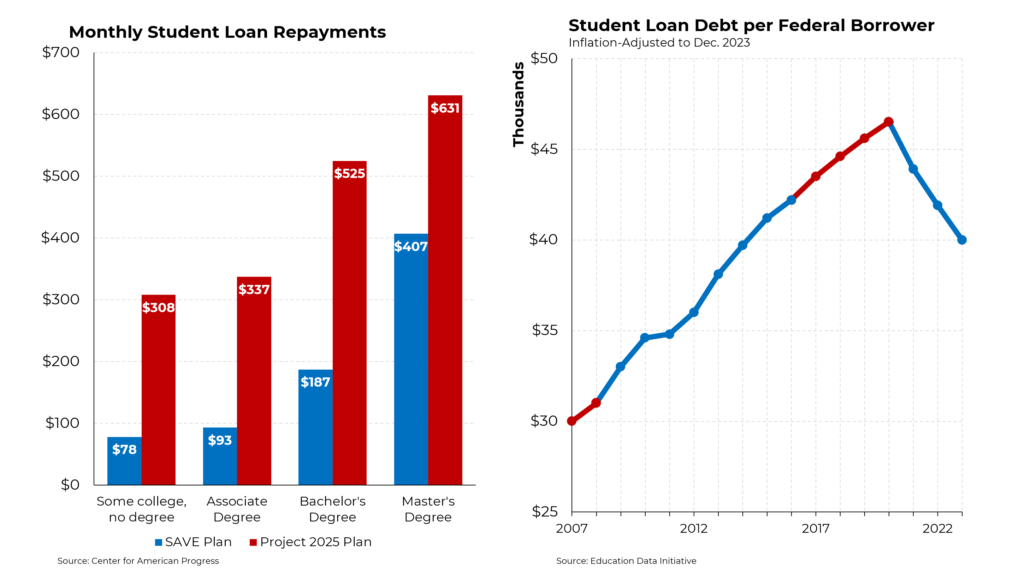

Then there’s student loan debt repayment. Project 2025 would phase out the Biden SAVE plan, which featured income-driven repayment and various other forms of relief. As a result, average monthly loan repayments would soar, nearly quadrupling for those with the least amount of education (and presumably, the least financial means) and rising substantially for those with college and graduate degrees.

It’s important to note that the SAVE plan and other measures taken by Mr. Biden to address the student debt problem have resulted in the first declines (even after adjusting for inflation) in student debt in at least five years.

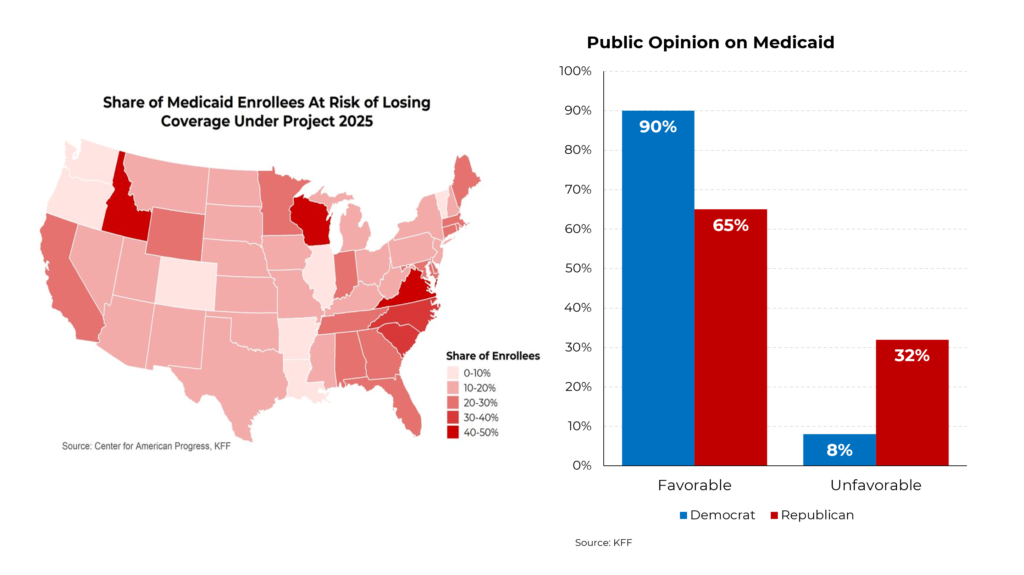

Finally, consider Project 2025’s plans for Medicaid: “targeted time limits or lifetime caps on benefits to disincentivize dependence.” According to a study by the Center for American Progress, this could result in as much of half of enrollees losing their coverage in several states and significant percentages losing coverage in virtually every state.

Like many of Project 2025’s ideas, this should be of political help to Democrats: an overwhelming percentage of Democrats and a substantial majority of Republicans have a favorable opinion of Medicaid.