As President Biden closes out this third calendar year as president, with reelection looming, what does his economic scorecard look like? While it’s been a bit of a bumpy ride, his economy is ending 2023 on a strong note. And although next year looks to be another year of solid performance, none of that has provided him with much help on the political front.

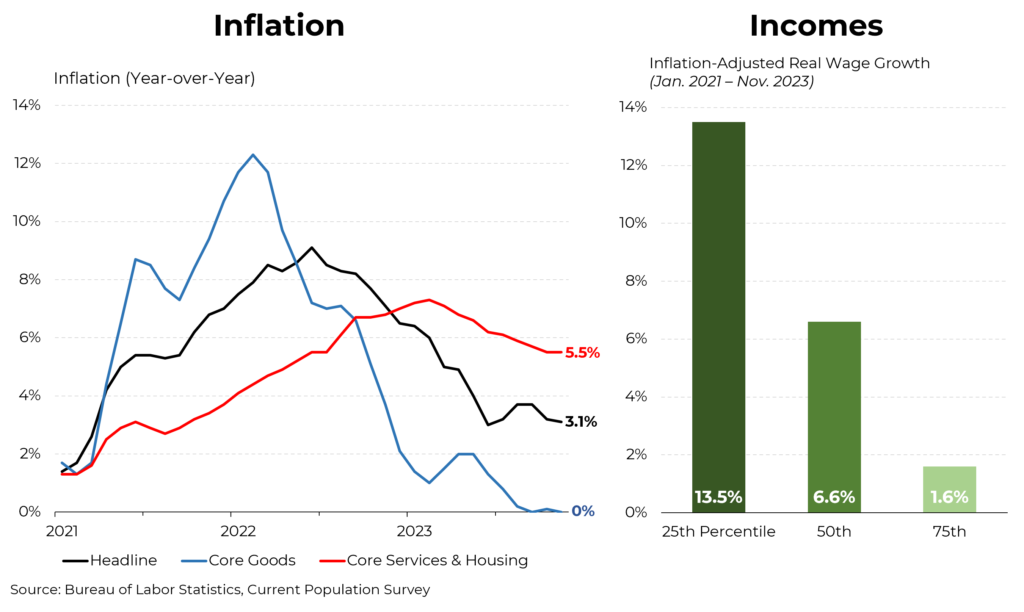

Yes, we had a good bit of inflation as the nation emerged from the pandemic and began spending money again. And the polls almost universally suggest that Americans don’t feel that they are better off than they were three years ago. But they are. For starters, inflation, which reached 9.1% in June 2022, is now down to 3.1%. Perhaps more remarkably, on average, the prices of many goods – from cars to televisions to furniture – have not risen at all for several months. Even food inflation is below 3%, and gasoline is down to a national average of $3.11 per gallon from $5.01 in June 2022. (Housing inflation remains high but much of that is due to the peculiarities of how the government calculates housing costs.)

What might be even more surprising to most Americans is that even after adjusting for inflation, median wages are up substantially, by 6.6% since Biden took office. And still more remarkably, after years of widening income inequality, those in the bottom quarter saw their inflation-adjusted incomes rise substantially faster than those in the top 25% – 13.5% versus 1.6%.

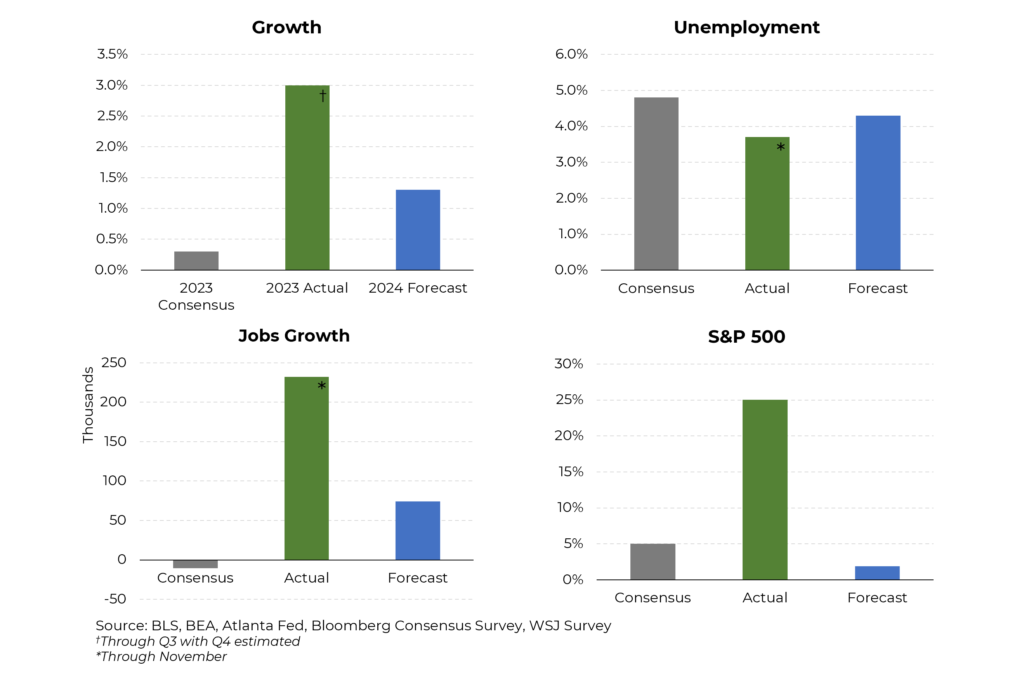

Apart from inflation, the economy performed substantially better in 2023 than a consensus of economic forecasters predicted at the start of the year. While economists expected only a sliver of growth – and possibly a recession – the economy expanded by an estimated 3.0%. Unemployment was expected to end the year at just under 5%; it’s at 3.7%. Consistent with a rising unemployment rate, we were expected to shed jobs in 2023; instead we’ve averaged 232,000 new jobs a month (with December yet to be reported). And the stock market, forecast to eke out a small gain in 2023, instead soared by 25%.

For 2024, when Biden will face reelection, economists are a bit more optimistic than they were at the start of 2023: Growth is projected to be about 1.3%, unemployment could rise 4.3%, job growth may moderate to 74,000 per month and again, a small increase in the stock market is predicted. (Not on this chart: expectations that inflation will edge down to 2.4%.)

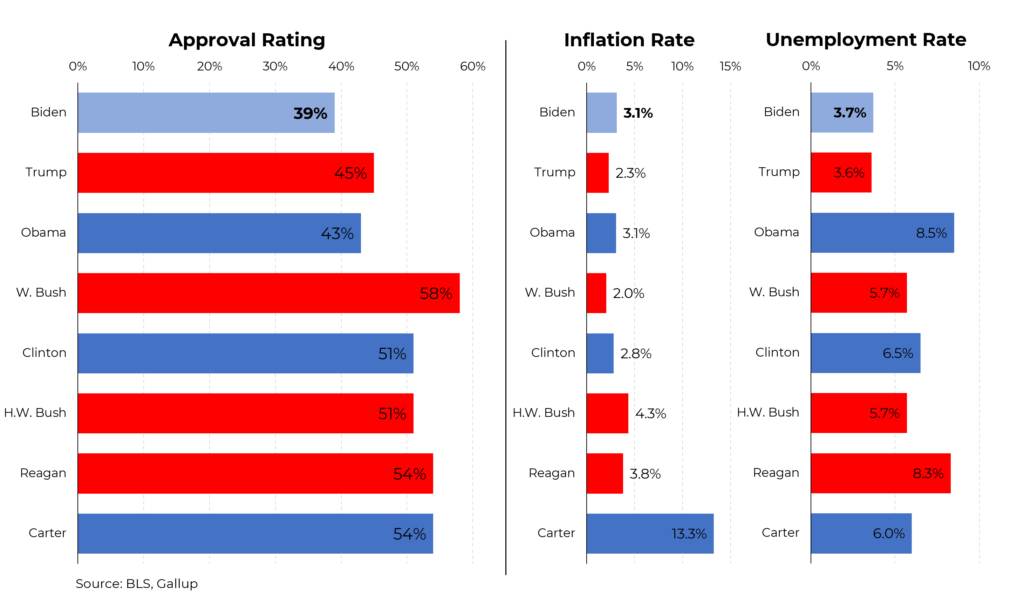

The conundrum for political experts is why this economic performance has not translated into better poll ratings for the president. No president since before Jimmy Carter has had poll ratings as low as Biden’s at this point before facing reelection. But Carter had a 54% approval rating, notwithstanding 6% unemployment and 13.3% inflation. Carter, of course, lost (although he also had the impediment of the Iran hostage crisis). Ronald Reagan, coincidentally, had the same approval rating as Carter, along with 8.3% unemployment and 3.8% inflation. But he won. (It is perhaps worth nothing that even at 3.1%, Biden is facing a higher inflation rate than any president since George H.W. Bush.)