Mike Johnson, the new Republican Speaker of the House, has lost no time in taking aim at a favorite Republican whipping boy: the Internal Revenue Service. Under the guise of offsetting the cost of aid to Israel, Johnson has proposed budget cuts for the IRS (on top of cuts the Republicans won during the debt ceiling debate). Increasing funding for the IRS has been a major Democratic initiative.

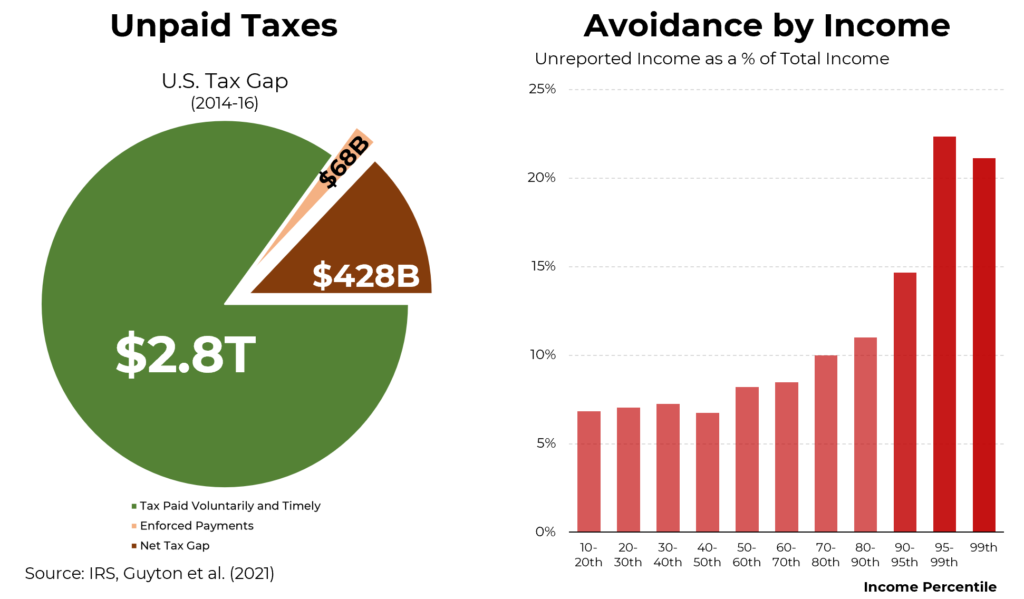

Why have the Democrats been trying to send more money to the IRS? Because experts agree that the amount of uncollected taxes is substantial. Between 2014 and 2016, Washington collected $2.8 trillion annually in voluntary income tax payments by individuals. IRS enforcement added a further $68 billion each year. But research by the IRS found that a further $428 billion per year went uncollected.

Perhaps not surprisingly, tax avoidance (or tax evasion) is more prevalent among the wealthy. Another study found that Americans in the top 5% (earnings of $290,000 and above) underpaid by more than 20% of their incomes. At the other end of the income scale, tax avoidance was a far smaller percentage and therefore, a significantly smaller amount of dollars.

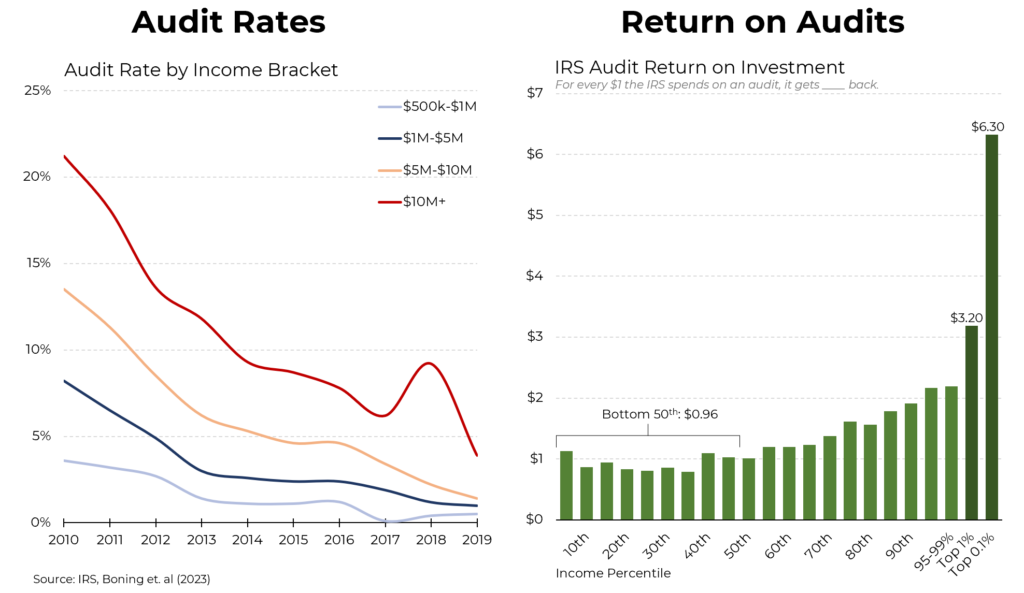

Tax avoidance has grown as the number of returns audited by the IRS has fallen (a consequence of past budgetary limitations). The probability of an individual with earnings above $10 million getting audited has fallen from over 20% in 2000 to under 5% today. The drop in audit rates has been steeper for higher incomes because those audits are far more time intensive and so, as the IRS has tried to stretch its dollars, those audits get cut first.

That’s not how it should work. Because of the higher rate of avoidance and the huge number of dollars involved, the return on spending is far higher when wealthier Americans are being audited. Every additional dollar spent auditing someone in the top 0.1% of incomes (over $9 million) yields $6.30 in additional taxes. In contrast, auding a filer below the 50th percentile (incomes of less than $75,000) produces less than a dollar of revenue for every dollar spent.

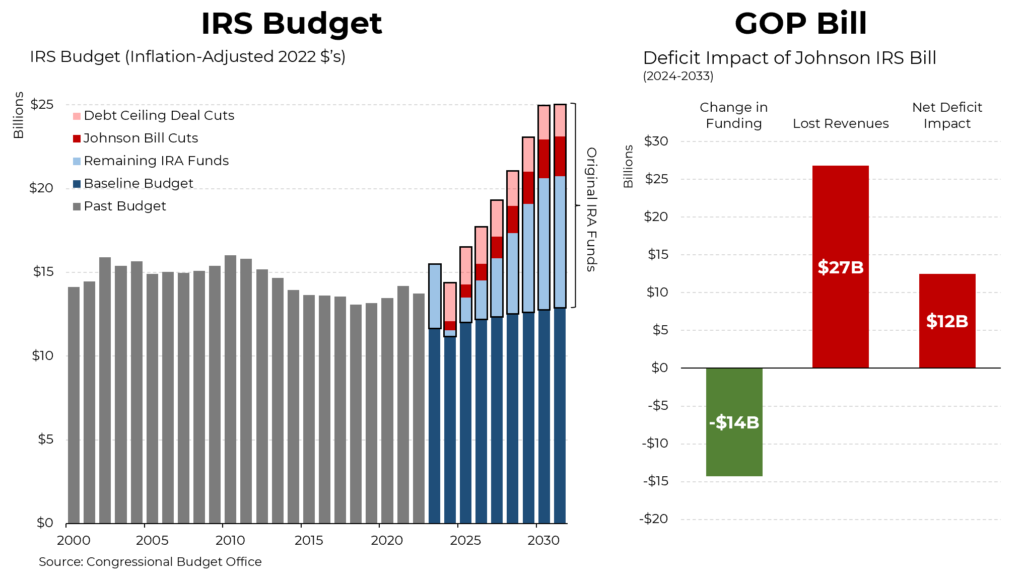

As noted, after adjusting for inflation, the IRS’s budget peaked in 2010 and fell by 13% over the following eleven years. Accordingly, the service’s staff fell to 79,000 in 2022, from 94,000 in 2011.

As part of the Inflation Reduction Act, the IRS budget was slated to almost double and staffing would increase to 100,000. But during the debt ceiling debate in June, Republicans carved back $20 billion of the $80 billion in the IRA. The new Republican plan would slice an additional $14 billion from the IRS budget.

But given the audit math, cutting the IRS’s budget by $14 billion will cost the Treasury $27 billion in lost revenues, for a net increase in the deficit of $12 billion.