Absent a surprise, the United Auto Workers are likely to strike one or more of the U.S. car companies at 11:59 pm, the latest in a string of labor actions. What has been going on with organized labor in the U.S. and why?

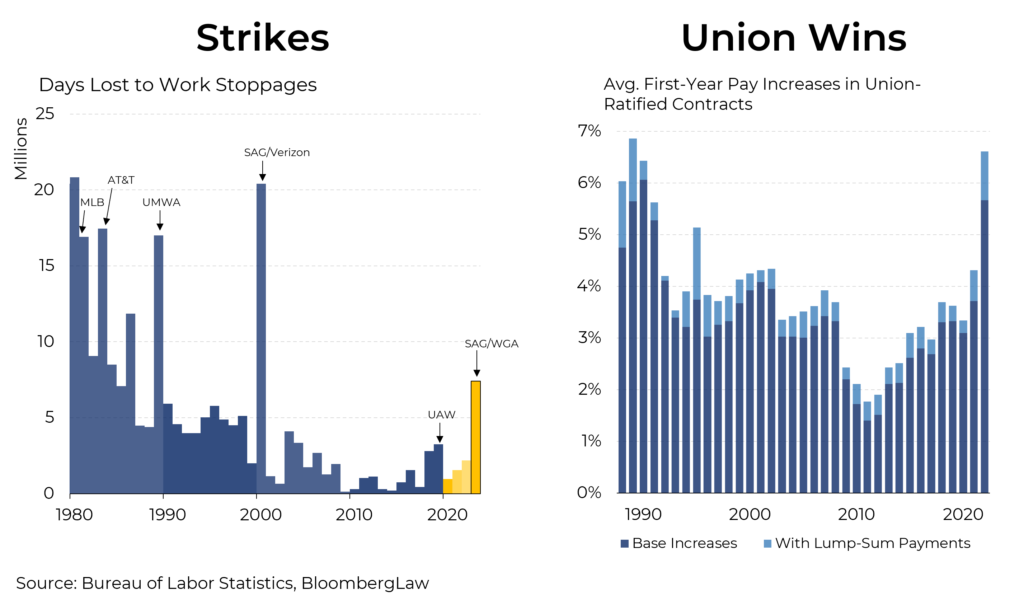

After many quiescent years, working days lost to strikes have been on the rise. So far this year, strikes have totaled 7.4 million working days, compared to 2.2 million in all of 2022. That itself was higher than most recent years. In 2014, for example, almost no days were lost to strikes. That, of course, was itself a dramatic change from previous periods in American history. Between 1980 and 2000, more than 15 million days of strikes occurred 5 times, including by baseball players, steelworkers, actors and miners. And that pattern was even moderate compared to still earlier decades. Between 1947 and 1999, an average of 24 million days a year were lost to strikes (including 60 million days in 1959). Some of that relates to declining union membership, which has dropped to 14.3 million Americans – roughly 10% of the workforce – from a peak of 21 million in 1979, representing a quarter of all laborers.

The new aggressiveness on the part of unions has produced some results (as have inflationary pressures). Recent contracts have yielded base pay increases averaging 5.7%, up from less than 2% a decade ago. Among the major wins: American Airlines pilots (46% average increase over 5 years) and UPS drivers (55% for at least some over 5 years.) Yet to be resolved: strikes by actors, screenwriters, and Los Angeles hotel workers.

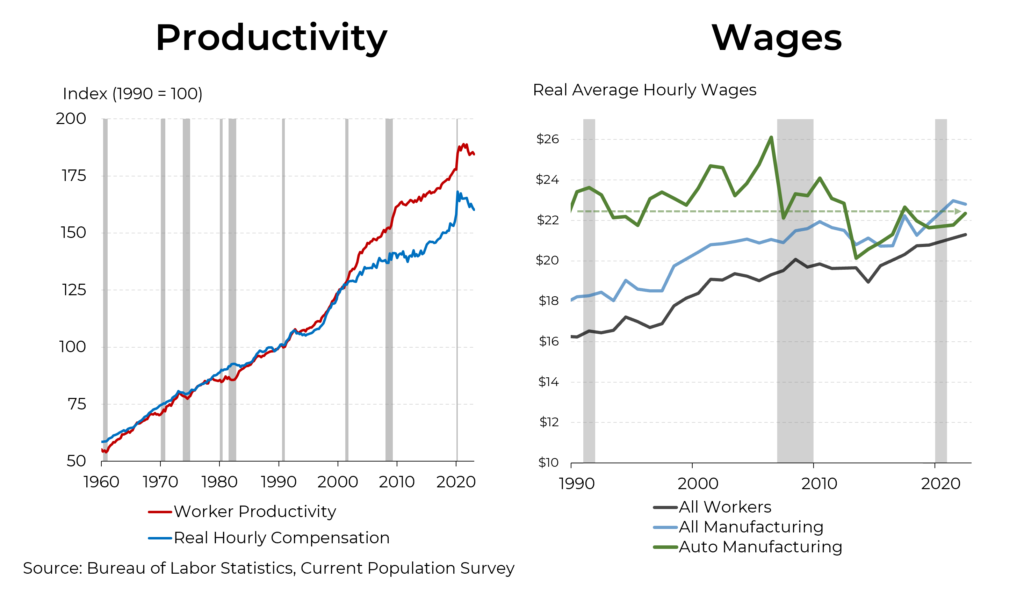

At least two factors lie behind the surge in strikes. For starters, a 3.8% unemployment rate and an abundance of unfilled jobs have emboldened workers whose pay has lagged their improved productivity. Historically, compensation and the output of an individual worker have been closely linked. But starting around 2000, these two variables have diverged, with efficiency gains outstripping wage gains. Why did this happen? A variety of factors, including declining unionization and tougher cost controls by companies.

Also contributing to these limited gains by workers has been global competition, particularly in manufacturing sectors like cars. Indeed, after adjusting for inflation, hourly earnings in the auto sector have been essentially flat since 1990 and increases throughout the manufacturing sector have been significantly more modest than in the country as a whole.

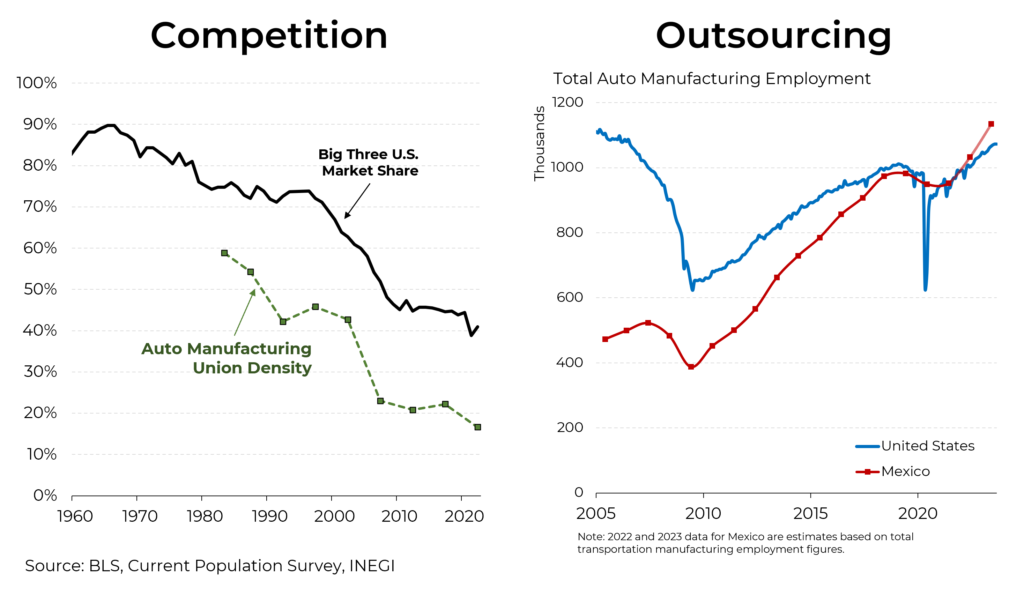

Unionized auto workers face a particular set of challenges. In part because of the higher cost of union workers, the big Detroit companies – General Motors, Ford and Stellantis (the parent company of Chrysler) – have been losing market share, down to 40% of U.S. car sales from a peak of 90% in 1964. Not surprisingly, union membership in the car sector has been declining in tandem. That means less bargaining power.

Who has benefited from the car sales lost by the Detroit 3? Many of the jobs and sales have moved to the south, which is largely ununionized. But many have also moved to Mexico, which has still lower labor costs. The Detroit 3 now have 20 manufacturing facilities in Mexico, while non-US car companies have many more. Wages in Mexico average $8 a day and even at GM’s newly unionized factory in Mexico, wages range from $9 to $33 a day. As a result, the number of auto workers in Mexico now exceeds the number in the U.S.