As expected, the Federal Reserve left interest rates unchanged on Wednesday and also as expected, signaled that at least one more rate increase may be in the offing. But amidst continuing economic strength and inflation still well above the central bank’s 2% target, the Fed also indicated that rates are likely to remain higher for longer.

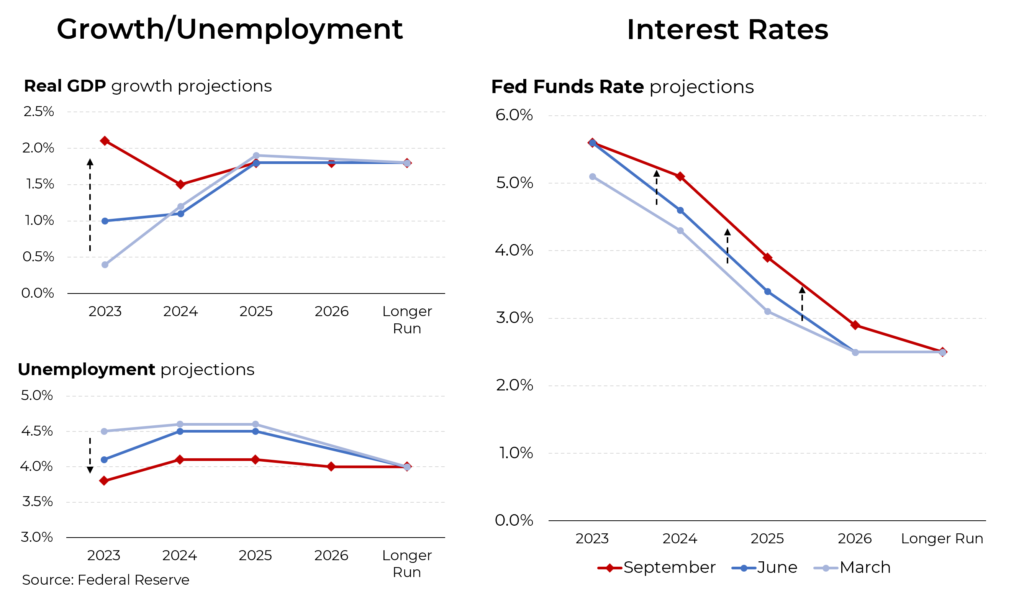

As part of its meeting, the Fed released new economic forecasts. The good news is that the economy is now expected to grow by 2% this year, up from 1% projected in its June forecast – and roughly half of that in its previous two forecasts. And the Fed, whose more optimistic view of the path of gross domestic product mirrors that of private economists, also raised its projection for growth next year to 1.5%, compared to just 1.1% in its June forecast. In the same vein, unemployment is now expected to be materially lower, rising only slightly to 4.1% next year, well below the 4.5% previously anticipated.

As a consequence of this more robust outlook, the members of the central bank’s interest rate setting committee believe that rates will also stay higher for longer, roughly 0.5% above previous forecast. As part of that, the bank expects another 0.25% hike. That has positive implications for savers but less good ones for borrowers. The implication of this possible path for the interest rate that the Fed controls is that mortgage rates, currently just above 7%, are unlikely to decline significantly for the foreseeable future. In other words, the era of bargain basement interest costs is almost certainly over.

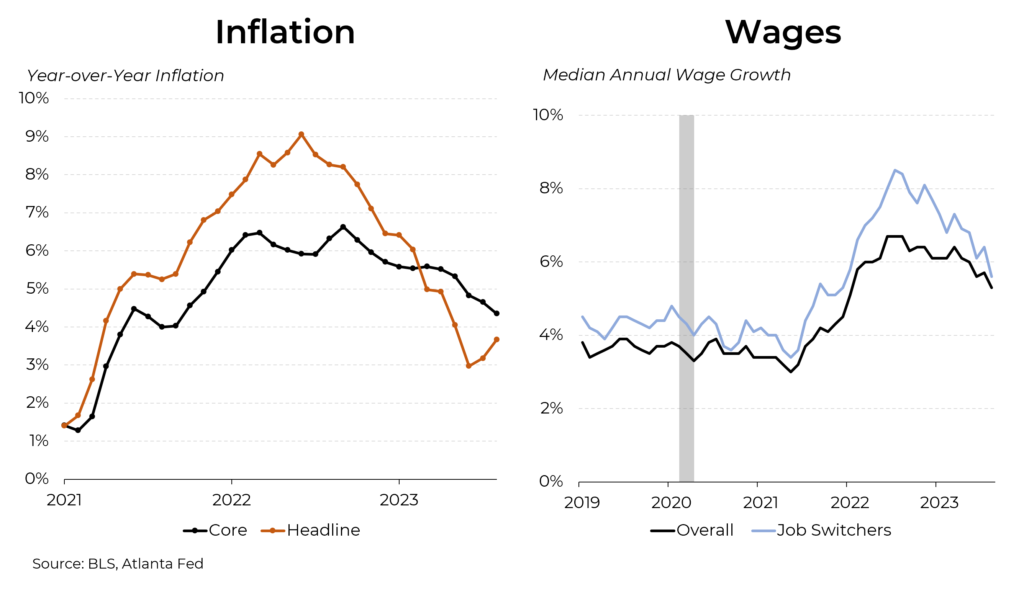

On the inflation front, the Fed left its forecast largely unchanged. But it also does not expect inflation to come down to its 2% target until 2026. Yes, inflation has retreated materially from its high in the middle of last year. But some of that is a bit deceptive, as it relates to the volatile categories of food and energy. Stripping those two categories out, prices in August rose by 4.3% year-over-year.

Further improvement in the inflation picture will likely depend on the pace of wage growth. While we all want Americans to earn more, if that simply becomes higher prices, no one benefits. At present, wages have been rising by more than 5% over the last year, which is consistent with roughly a 4% inflation rate. On the positive side, wage increases won by Americans who switch jobs have come down significantly, suggesting the great labor market churn of the last two years is mostly behind us.

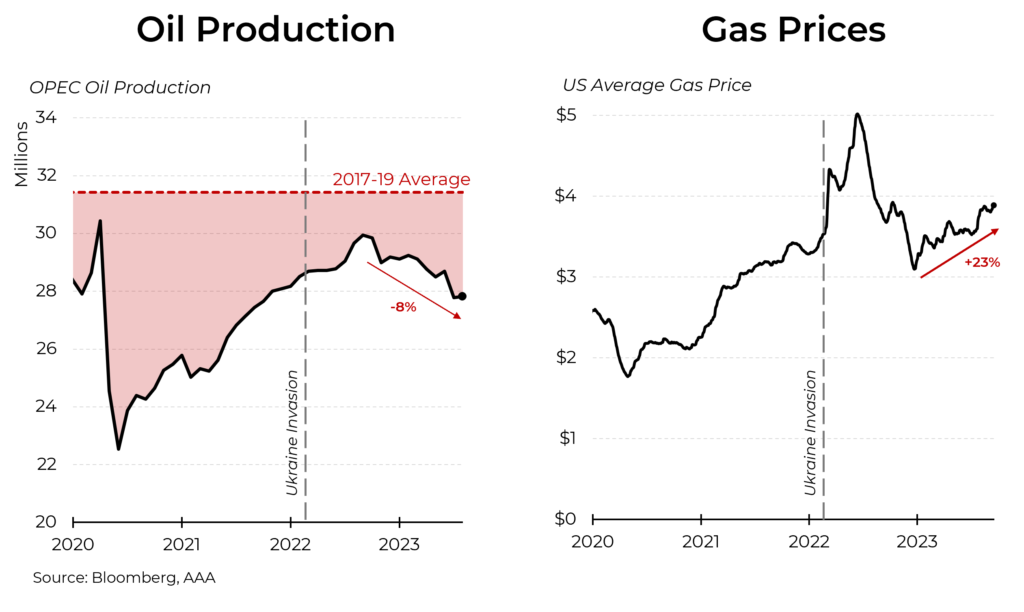

Another recent development could create more inflationary pressures (and political challenges for President Biden): Oil prices have been on the rise. That’s because OPEC+, led by Saudi Arabia and Russia, have been cutting production, down to 28 million barrels a day compared to the mid-2022 peak of 30 million barrels a day. Consequently, crude oil prices have risen by 30% since June, with oil produced in the U.S. now selling at $90 a barrel.

That has translated into rising gasoline prices, up almost $1 since January, to an average of $3.88 a gallon. (The last peak in prices was $5 a gallon in June 2022.) In California, the average price is now $5.80 a gallon.