The Fed Hikes, Again

July 27, 2023

By STEVEN RATTNER

As expected, the Federal Reserve yesterday both increased interest rates by 0.25% and signaled a “wait and watch” approach to any further rate. The decision comes as inflation has retreated, even as jobs and overall economic growth has remained stronger than many expected.

:

:

Wednesday’s increase brought the central bank’s base rate to a target range of 5.25% to 5.50%, the highest since 2001. But both the credit market and the Fed have been indicating that if we are not at the top of the rate tightening cycle, we are close, with perhaps one or two more 0.25% increases left to come. Then, if inflation continues to abate as all parties hope, rates could decline to as low as 3.5% by the end of 2025.

But consumers neither receive nor pay the Fed funds rate – so what does this mean for them? Not surprisingly, both savings and lending rates track the central bank rate, albeit with lags and deviations. Before Covid, money market funds were paying between 2% and 3%, while the 30 year mortgage hovered around 4%. During Covid, when the Fed cut interest rates almost to zero, these rates also fell. And since the Fed began hiking in March of 2022, other rates have followed suit. (Note that bank depositors have not seen the same uptick in what they receive, although movement of funds to money market funds from banks will likely pull this up a bit.)

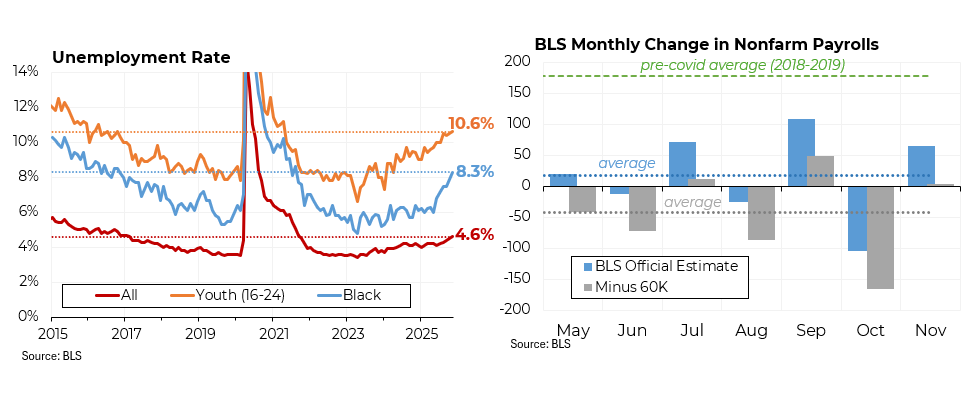

The steady increase in interest rates is partly the result of an economy that is performing better than expected. Unemployment is at 3.6%, near its lowest level in 54 years. The economy added another 209,000 jobs last month, and while a slower rate of increase than previous months, it brings the total number of jobs added during President Biden’s term to 13.2 million, the fastest growth ever for a new president. All told, a consensus of economists now expect the economy to grow by 1.5% this year. That’s not huge, but it’s up from a low of 0.3% in January.

That said, the much discussed “soft landing” is still far from a certainty. Forecasts for growth next year have been falling and now stand at 0.6% for 2024. In the same vein, more than 60% of economists still expect a recession in the next 12 months. (For his part, Fed chairman Jerome Powell said Wednesday that the central bank staff is no longer projecting a recession in the next year.)

What the Fed does in coming months and whether a soft landing is achieved will depend heavily on two related factors. First, inflation needs to continue to decline to the Fed’s 2% target. In May, the central bank’s preferred inflation measure – the “core” (excluding energy and food) Personal Consumption Expenditures index – rose by 4.8% over the previous year; when the June figure is released on Friday, forecasters expect this to decline to 4.2%.

For inflation to continue to abate, the pace of wage increases needs to continue to moderate to somewhere between 3% and 4%. Most recently, this measure stood at 5.6%. With more than 9.8 million unfilled jobs – 1.6 for each American looking for a job – this may be among the economy’s biggest challenges.