As expected, the Federal Reserve raised interest rates by 0.25% on Wednesday, the latest in a string of increases that has brought the benchmark rate from near zero a year ago to the current range of 4.75% to 5%. But following a string of crosscutting economic and financial developments, the path to today’s decision was far from smooth and uncertainty about the future path of rates abounds.

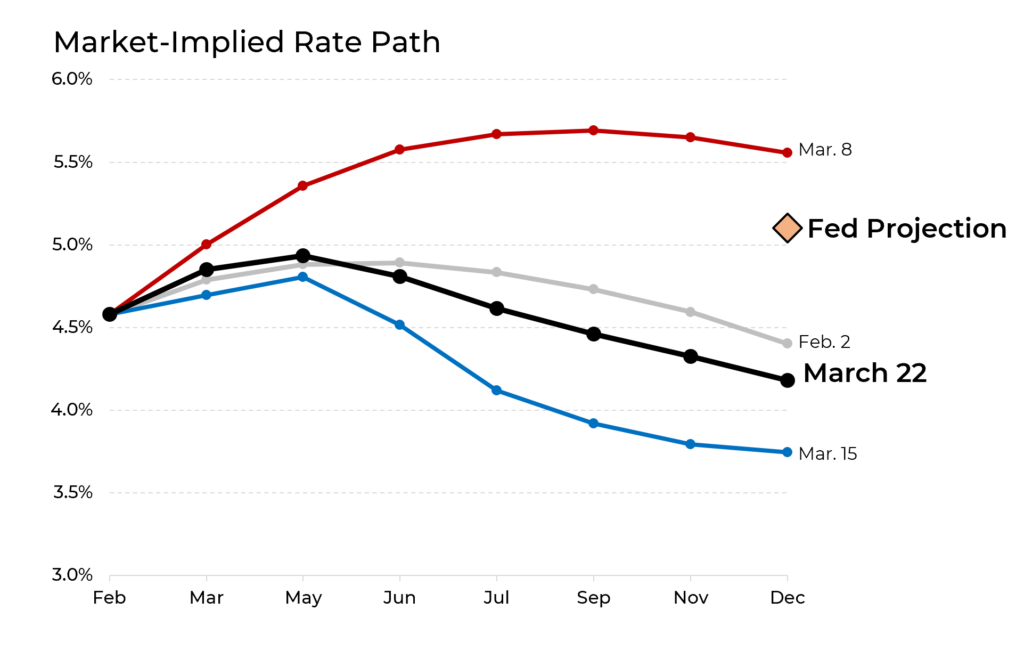

At the beginning of February, with the economy appearing soft, the futures market projected that rates would peak below 5% and then begin to decline, ending this year at about 4.25%. Then signs of greater economic strength caused expectations to shift dramatically, with rates reaching 5.75% in the middle of the year and declining only modestly thereafter. The demise of Silicon Valley Bank caused a violent shift in sentiment, with the projected year-end rate dropping to 3.75%. That was a week ago. Now, with the banking crisis seeming to ebb, the anticipated rate in December is 4.25%.

For its part, the Fed has a different view. In projections released on Wednesday, the Fed expects rates in December to still be above 5%.

Why does this matter? The level of interest rates has a big impact on both consumers and businesses. And what the Fed, with its nearly 1,000 economists, thinks is going to happen is important to understand.

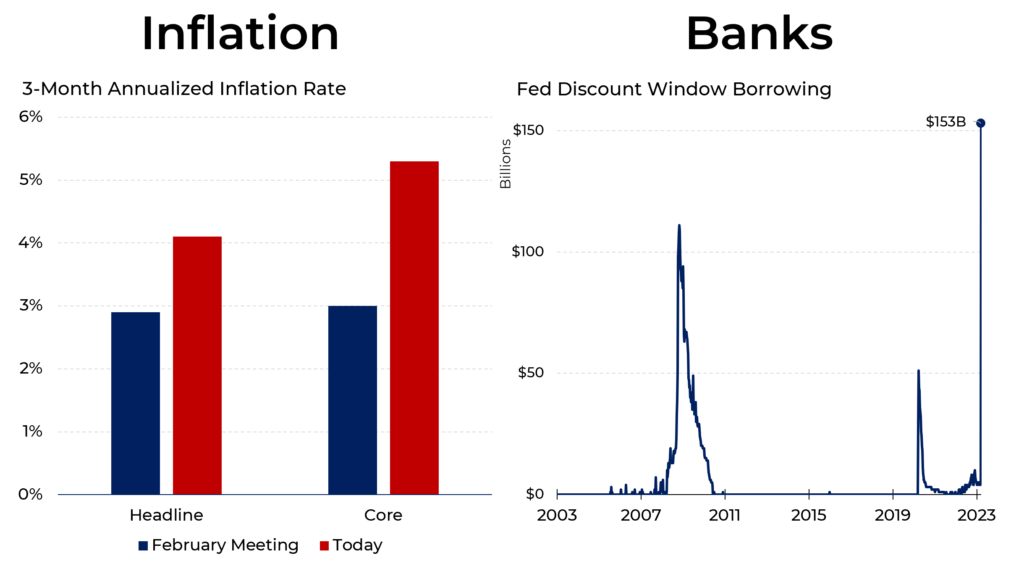

In choosing to raise rates, the Fed faced a tricky decision. On the one hand, inflation has not been coming down as all would hope. At the time of its February meeting, when the Fed also raised its key rate by 0.25%, inflation was running at around 3%. (“Headline” refers to overall price movements while “core” excludes the volatile components of food and energy.) By the time of Wednesday’s meeting, the three-month annualized rate was over 4% and, even more worrisome, the core rate was over 5%.

On the other hand, the banking system remains fragile. One measurement is the amount that banks borrowed from the Fed last week through what is known as the “discount window”. That amount – $153 billion – is higher than even at the previous peak during the financial crisis. More signs of stress remain in the banking system, as Fed and Treasury officials wait with bated breath to see if other bank runs occur.

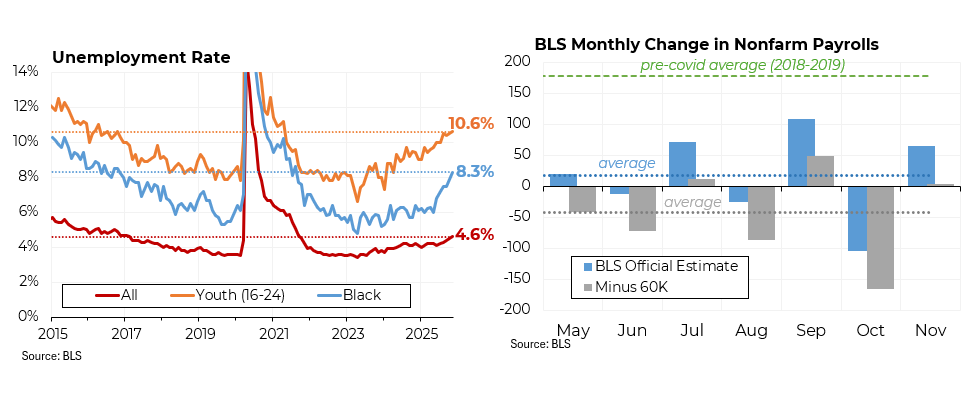

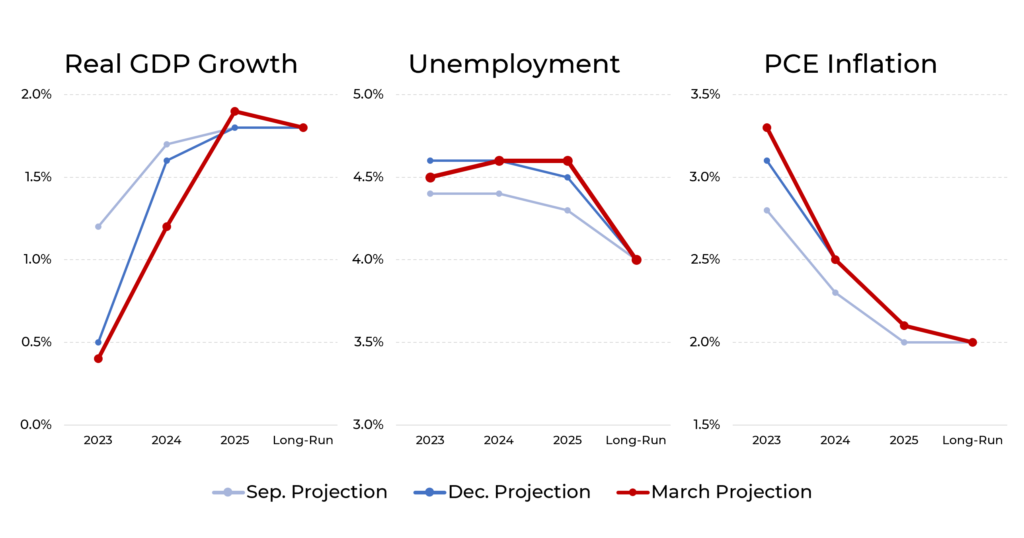

As part of Wednesday’s announcement, the Fed released new economic projections, which constituted modestly more pessimistic expectations. Economic growth this year, which was projected to be as high as 1.25% in the Fed’s September 2022 outlook, is now down to less than 0.5%. The unemployment projection remains around 4.5% (up from 3.6% currently), and PCE inflation (the Fed’s preferred index) this year is likely to be 3.3%, still meaningfully above the Fed’s target of 2.0%.