The Consumer Price Index for February came in a bit stronger than economists had expected, but recent bank failures have complicated the Federal Reserve’s job and raised questions about what the central bank’s policy committee will do when it meets next week.

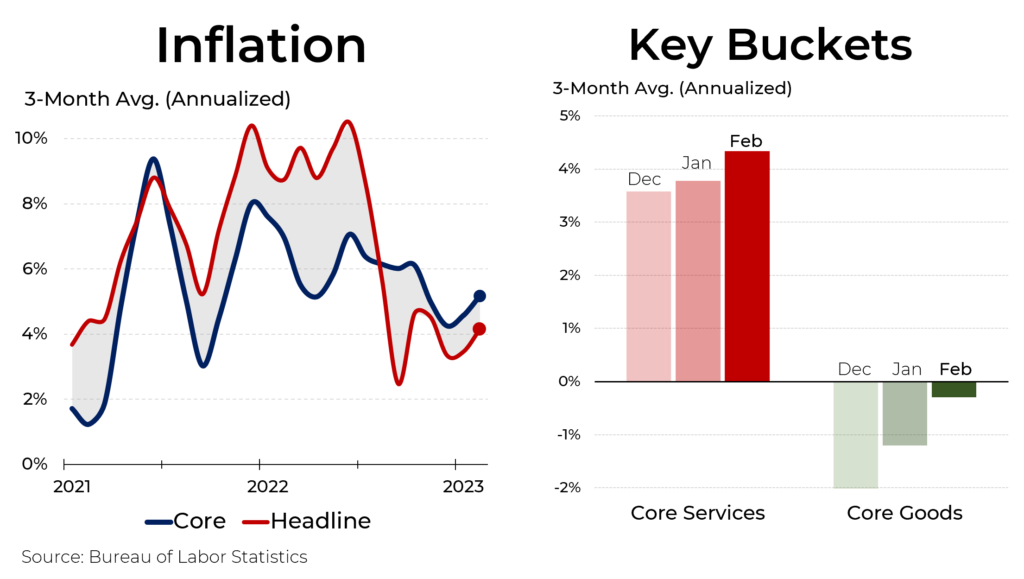

In February, prices rose by 6% compared to a year earlier, but with so many moving pieces in the economy at the moment, looking at shorter term trends can be more instructive. Using a three month trailing average shows that after hitting a low of a 3.3% annual rate in December, the overall price index rose at a 4.2% rate in February. More concerning is that core inflation – excluding the volatile categories of food and energy – also reaccelerated to a 5.2% rate, substantially above the Fed’s target of 2%. (Note that the Fed’s preferred price measure is the Personal Consumption Expenditure index, which is also meaningfully above the Fed’s target.)

Within “core inflation,” the Fed looks most closely at services, the prices of which are heavily driven by wages. The February news in that category was also not good, with the three month annualized rate increasing to 4.3%. Goods prices, which had been problematic when the economy was plagued by Covid-related factors, including supply chain problems and excess demand, have been decreasing, albeit at a slower rate.

(Housing inflation, which accounts 40% of the “core” basket, is also high, at 9.5% annualized. However, housing is measured with a significant lag in the CPI, and real-time trends indicate cooling in the sector.)

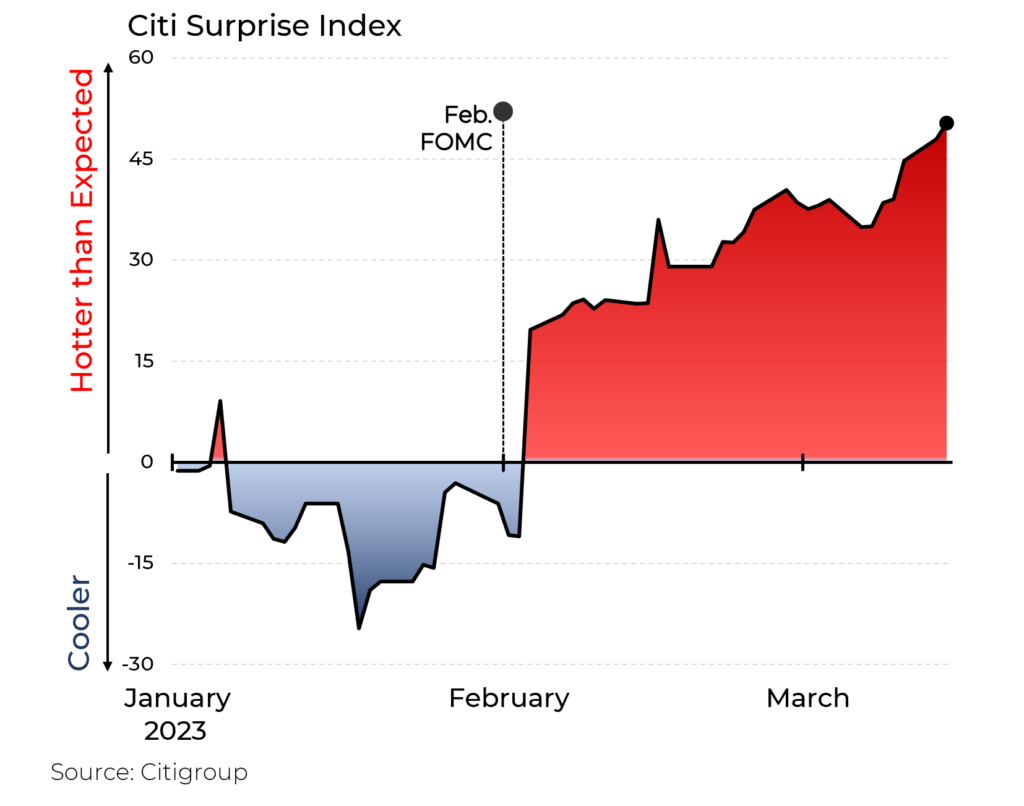

Meanwhile, other recent data depict an economy that has been performing better than most forecasters expected. Until early February, many of the economic indicators were coming in roughly in line with expectations or a bit weaker. Since then, the surprises have been on the upside. For example, in January, the economy added a stunning 504,000 jobs, far above the 189,000 that had been expected. The February figure came in at 311,000 jobs, still higher than the predicted 225,000. Retail sales in January rose by 2.6%, compared to forecasts for 0.9%. And so on.

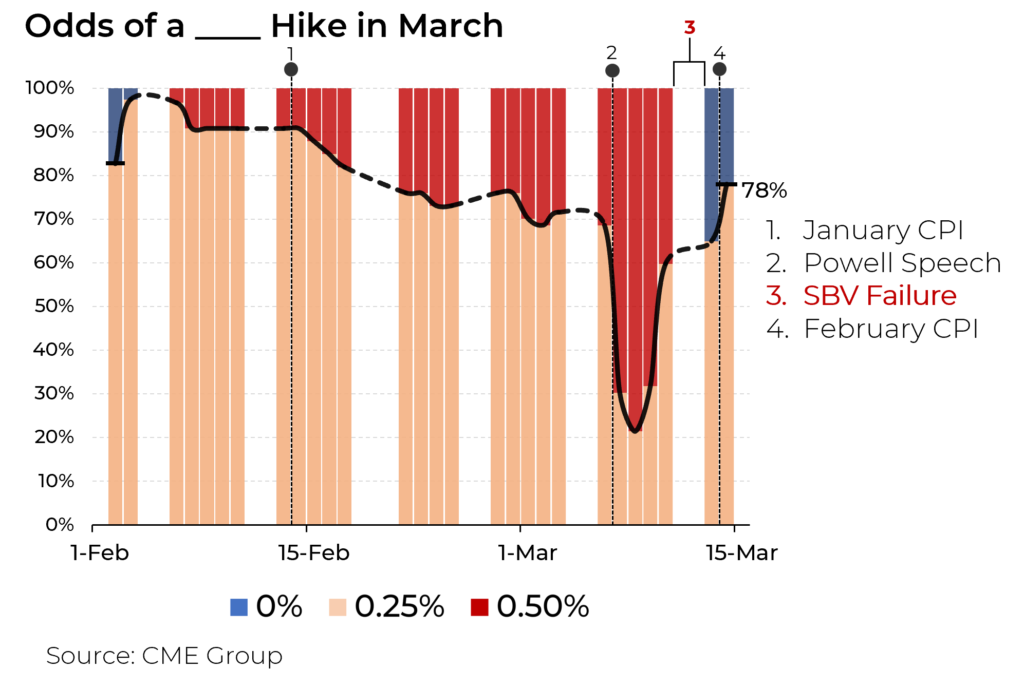

Those positive surprises led analysts to predict that the Fed, which increased interest rates by 0.25% in January, would revert to the 0.5% pace of increase that it approved in December. On March 7, in his regular congressional testimony, Fed chairman Jerome Powell confirmed that the Fed would likely revert to a more hawkish stance. That led odds of a 0.5% increase at next week’s meeting to rise to a peak of 79%.

But then stresses began to emerge in the banking system, culminating in the closure of two failing banks earlier this week. With higher interest rates being blamed for some of the stresses in the banking system, the market quickly revised its views. At present, the odds of a 0.25% increase stand at roughly 80%, with a 20% probability assigned to no increase at all.