Last Friday’s extraordinary jobs report was just the latest in a string of recent data that show a strong economy, including signs of moderating inflation. In addition to the good news on jobs, the most recent report on overall economic activity showed that real gross domestic product grew at a 2.9% annual rate in the fourth quarter, following 3.2% growth in the third quarter.

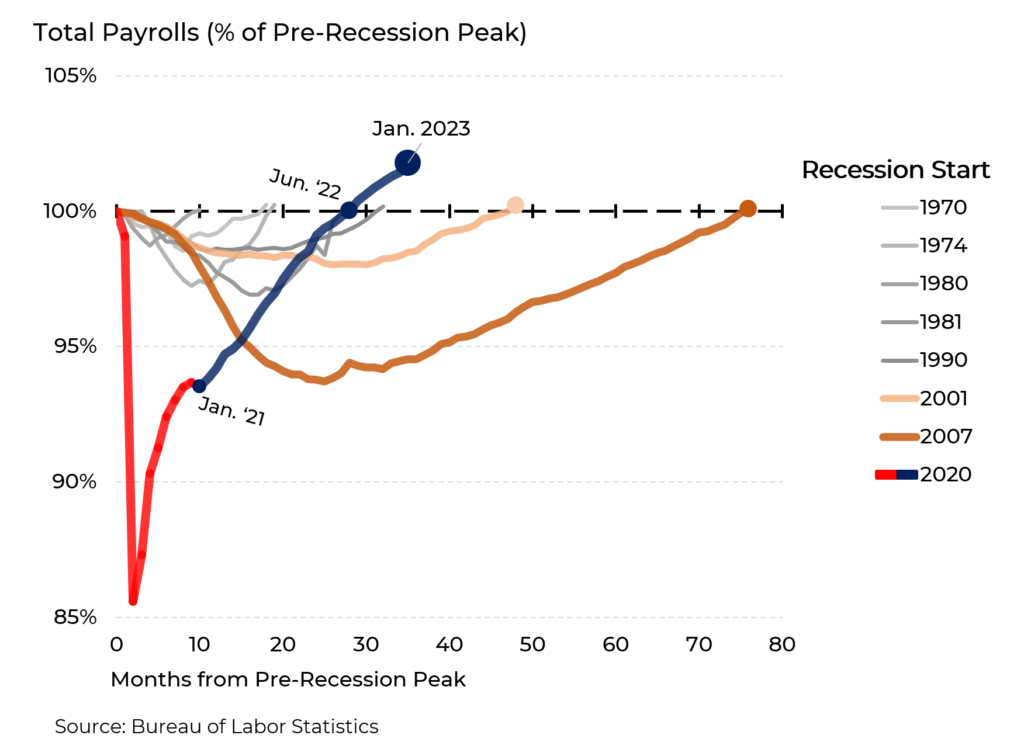

The Great American Jobs Machine grinds on. In January, 517,000 new jobs were added, far more than analysts expected and well above normal levels. As President Biden said in his State of the Union address, that brings the total number of jobs created on his watch to 12.1 million – more additions in two years than any president has seen in four. Perhaps even more amazing, more Americans are now at work than were employed before the pandemic struck in early 2020. That is a faster job recovery than occurred after the financial crisis or after the dot-com implosion in 2001.

Interestingly, the overall job recovery has occurred even though government jobs and employment in leisure and hospitality remain about a half million below pre-Covid levels.

And the unemployment rate, at 3.4%, is the lowest since 1969.

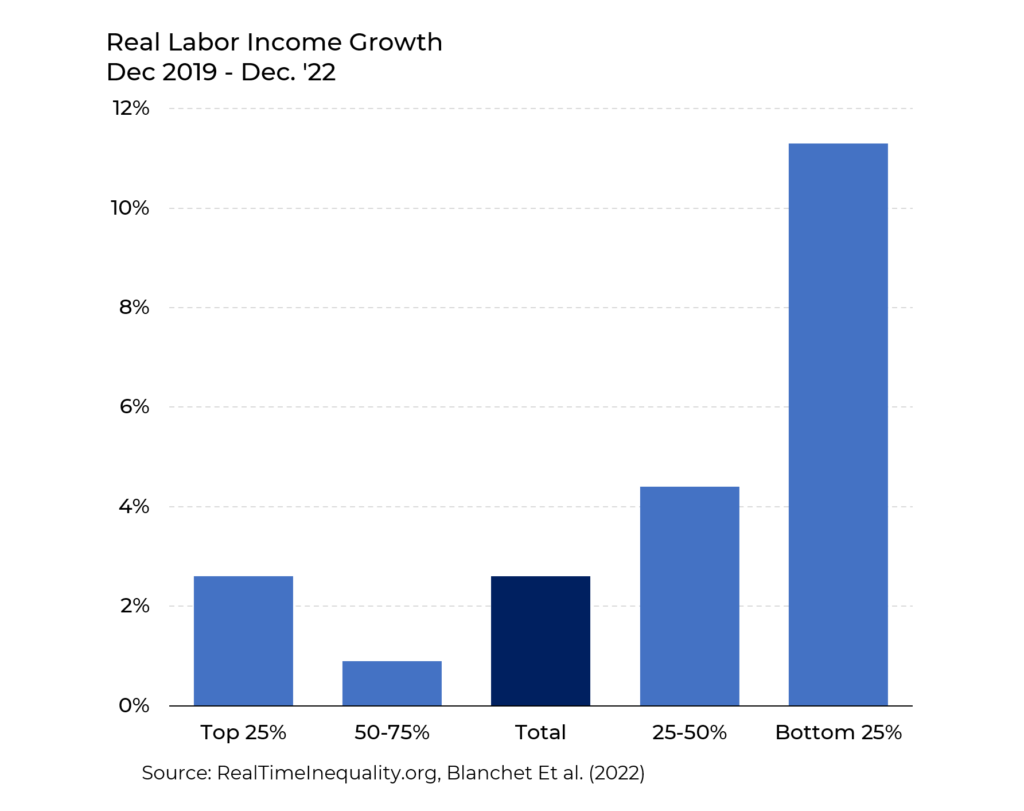

Wages, even after adjusting for inflation, have also done better than many Americans believe. Average incomes are about 2.6% higher than pre-Covid levels. Perhaps more importantly, wages for those at the bottom have risen faster than for other Americans for the first time in many years. The bottom quarter of Americans (by income) have seen their real incomes rise by a whopping 11.3% over the past four years, compared to 2.6% for those in the top quarter.

Real wealth has shown a similar pattern – up 16.5% on average but up 129% for the bottom half of Americans.

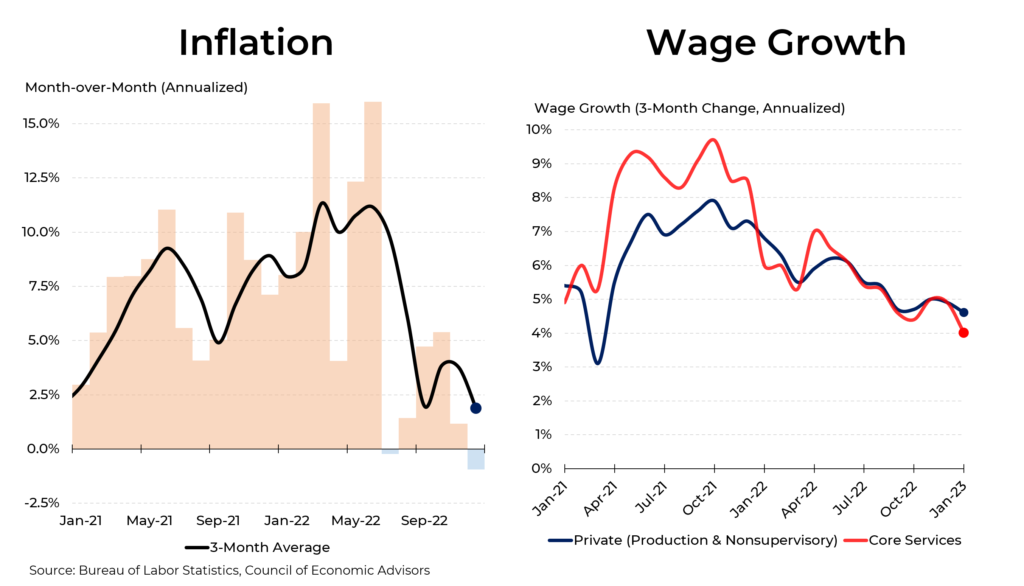

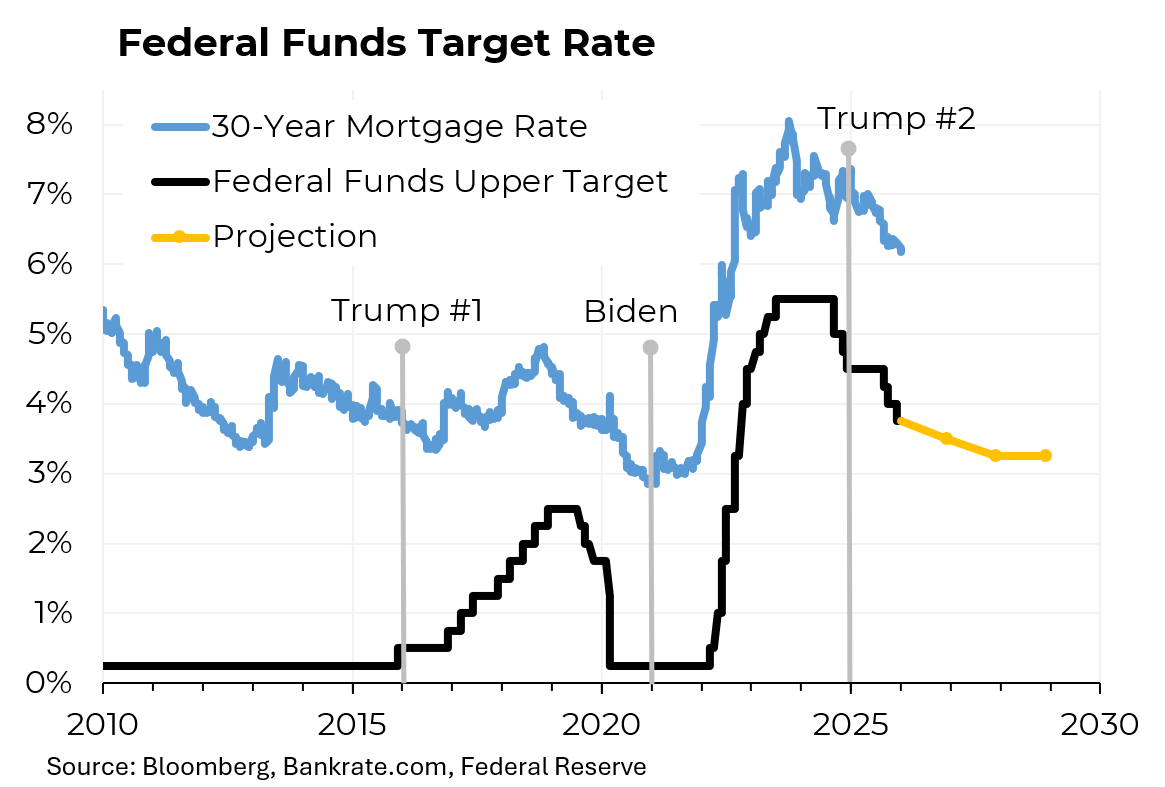

All that good news notwithstanding, the focus of many Americans is on inflation – and rightly so. The Federal Reserve has already raised interest rates to almost 5% from near zero, and earlier this week, the Fed’s chairman, Jay Powell, said that more hikes are to come. Yes, inflation has come down substantially and overall prices actually fell in December. But most economists expect inflation to remain meaningfully above the Fed’s 2% target at least until wage increases continue to move down (to perhaps 3%). At present, they are still running at between 4% and 5%, depending on which measure of wages one looks at.