On MSNBC’s Morning Joe today, Steven Rattner charted yesterday’s collapse in Facebook/Meta’s stock, explaining what led to the selloff and noting which other technology firms have also fallen far from their peaks.

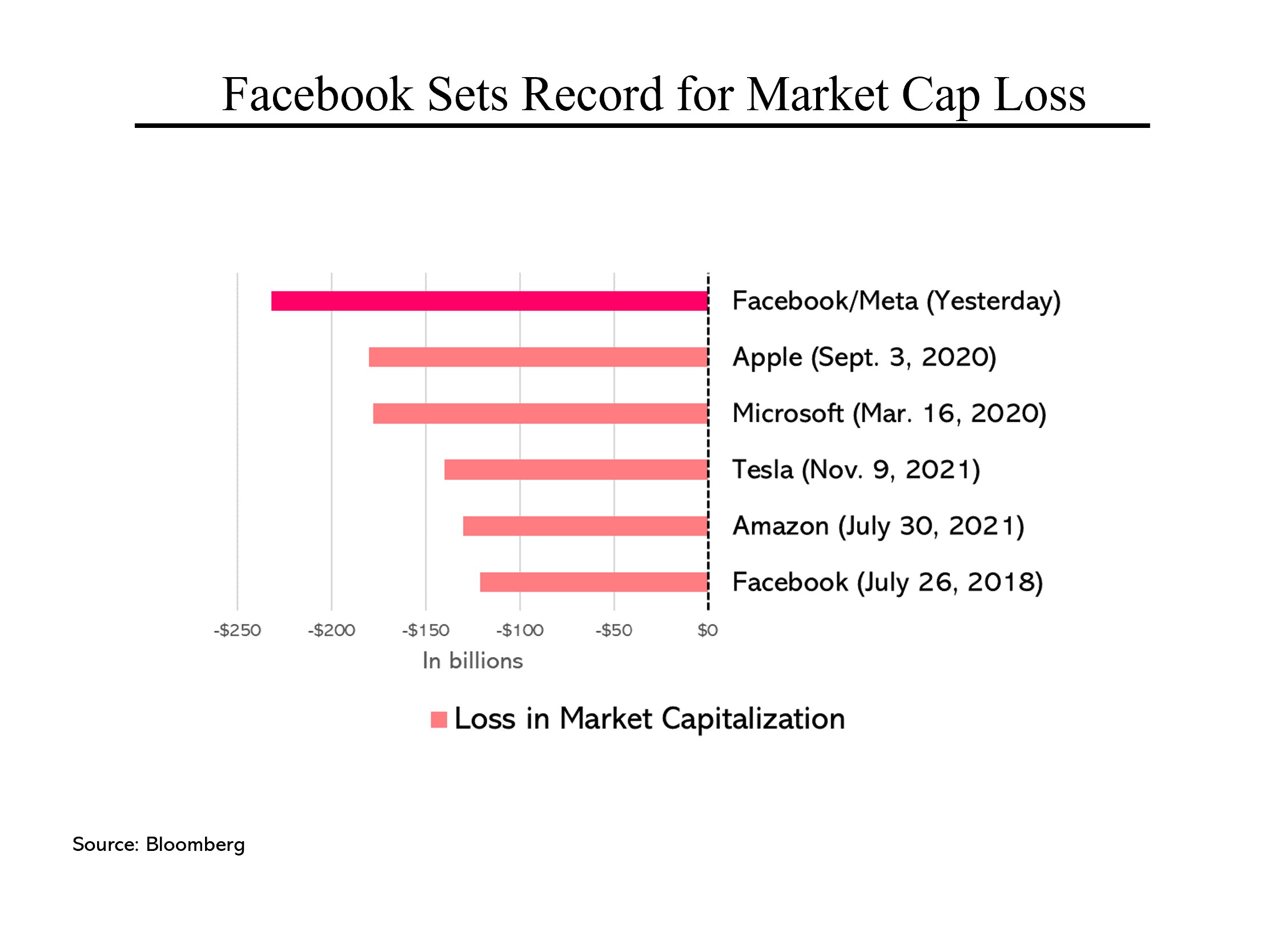

Meta (formerly known as Facebook) set a new record yesterday – the largest single day loss of market value in stock market history. That was just the latest shock to hit the high-flying tech sector in the past several months as rising interest rates and bumpy earnings reports take their toll.

Meta’s market value dropped by $231 billion yesterday ($31 billion of it Mark Zuckerberg’s). The proximate cause was a disappointing earnings report the night before. The company was hit by a change last year in Apple’s privacy policy that has made it more difficult for Facebook to target its ads as well as by its effort to pivot its business into what Zuckerberg calls the “metaverse,” a world organized around video and augmented reality.

Meta’s market value dropped by $231 billion yesterday ($31 billion of it Mark Zuckerberg’s). The proximate cause was a disappointing earnings report the night before. The company was hit by a change last year in Apple’s privacy policy that has made it more difficult for Facebook to target its ads as well as by its effort to pivot its business into what Zuckerberg calls the “metaverse,” a world organized around video and augmented reality.

Perhaps not surprisingly, all of the next five largest drops in equity value have been large, fast growing companies and all of them have occurred in the last several years (with Facebook appearing on the list twice). Some (like the drop in Apple in September 2020) happened for no particular reason except that the stock had been appreciating rapidly. Others had more identifiable triggers: Microsoft – the nation’s second largest company by market value — fell in the early days of the pandemic but has since more than recovered.

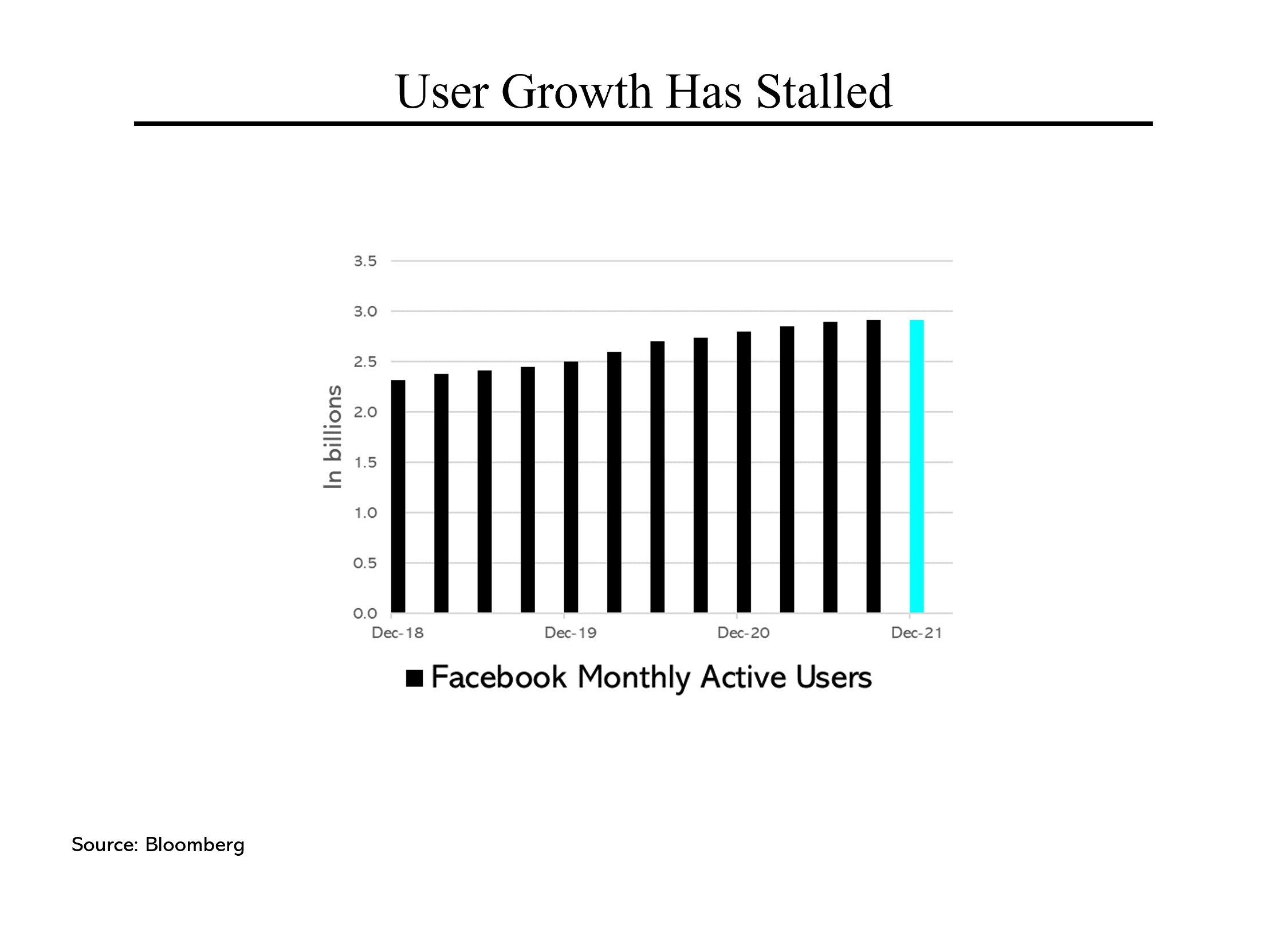

At least as worrisome for Facebook as the advertising targeting problem is flattening user engagement. Last month, Facebook lost daily users for the first time in its 18 year history, as young users pivot to TikTok. Other Meta subsidiaries, particularly Instagram and WhatsApp, are also experiencing soft user numbers. That is the existential reason for why Zuckerberg is moving into video (with its Reels product) and augmented reality.

At least as worrisome for Facebook as the advertising targeting problem is flattening user engagement. Last month, Facebook lost daily users for the first time in its 18 year history, as young users pivot to TikTok. Other Meta subsidiaries, particularly Instagram and WhatsApp, are also experiencing soft user numbers. That is the existential reason for why Zuckerberg is moving into video (with its Reels product) and augmented reality.

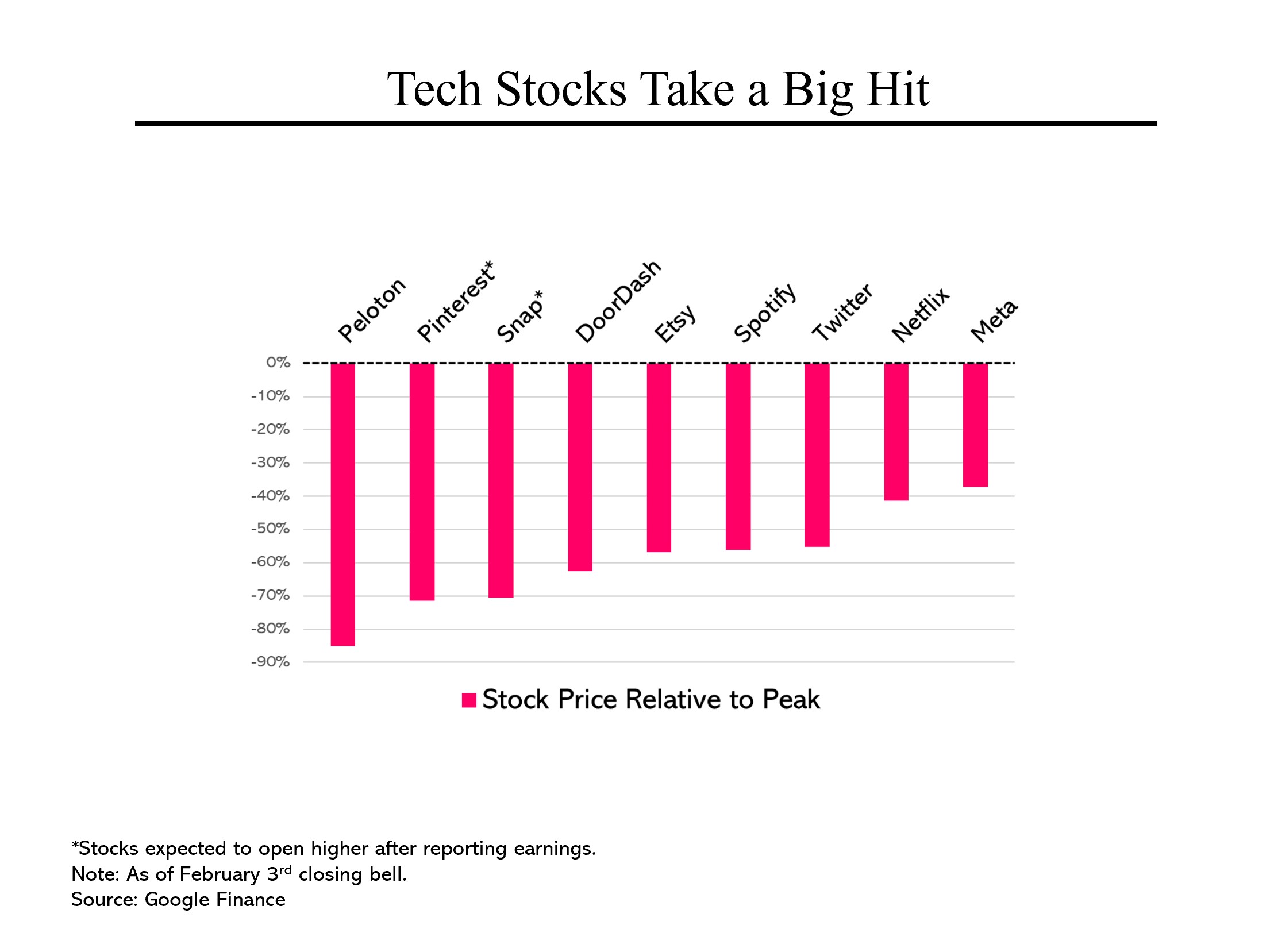

Meta is not alone in facing challenges in recent months. In fact, its decline from its peak valuation last September is relatively modest compared to some of the other declines. Peloton, for example, rode high on the back of Covid-related purchases. As soon as those tailed off, the market began to correct. Pinterest and Snap have suffered from some of the same competitive pressures as Facebook (although both reported strong earnings last night and opened substantially higher today). All told, the market has ceased to be forgiving of companies that have been trading at lofty valuations.

Meta is not alone in facing challenges in recent months. In fact, its decline from its peak valuation last September is relatively modest compared to some of the other declines. Peloton, for example, rode high on the back of Covid-related purchases. As soon as those tailed off, the market began to correct. Pinterest and Snap have suffered from some of the same competitive pressures as Facebook (although both reported strong earnings last night and opened substantially higher today). All told, the market has ceased to be forgiving of companies that have been trading at lofty valuations.