On MSNBC’s Morning Joe today, Steven Rattner discussed the lesson of past tariff experiences and likely impact of Trump’s import duties on the US economy.

With the imposition of tariffs on steel and aluminum imports from some of our closest allies, we are now in a full-fledged trade dispute, if not an outright trade war. The lesson of our past efforts to use tariffs to reduce imports is that this strategy almost always ends in tears. Four quick points about tariffs:

First, the efficacy of using tariffs to save jobs is doubtful. In 2002, President George W. Bush imposed steel tariffs in an attempt to arrest a sharp decline in employment in the steel industry. As this chart shows, the import duties succeeded in arresting the drop in employment for a short while but then it resumed its steep slide.

The tariffs were removed after just 21 months later due to retaliation (particularly by the European Union) and a ruling by the World Trade Organization that they did not comply with international rules. (In that instance, Canada and Mexico were exempted to avoid violating the terms of the North America Free Trade Agreement.)

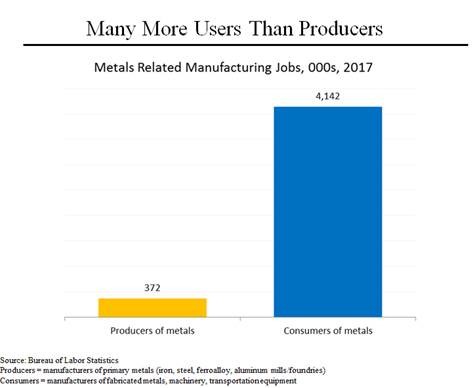

Second, tariffs on steel and aluminum can have repercussions that extend far beyond those specific sectors. This chart shows that the number of Americans employed in jobs that produce steel, aluminum and other metals is less than 10% of the number working in industries that use these metals. Tariffs have the effect of raising the price of an important raw material used by these companies, which ultimately costs jobs. The Bush steel tariffs are estimated to have cost 40,000 jobs in the steel-using sectors, far more than the number that was saved.

A recent Council on Foreign Relations study concluded that a 25% tariff on steel could result in the loss of 45,000 jobs in the auto industry alone, almost one-third of the steel industry’s entire workforce. The Trade Partnership has estimated that the new tariffs could cost five jobs for every one created.

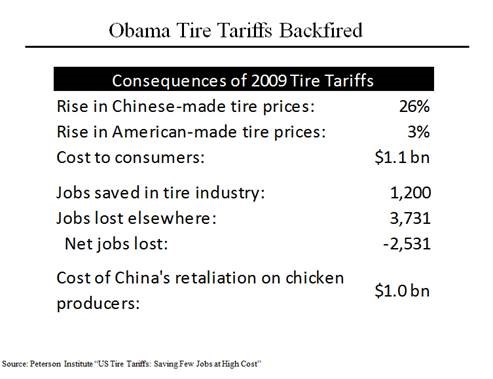

Third, the repercussions from tariffs extend beyond the manufacturing industry. When President Obama imposed tariffs on Chinese tariffs, the consequence was rising tire prices that cost American consumers $1.1 billion. The Peterson Institute estimated that the loss of consumer purchasing power resulted in three times as many jobs lost elsewhere as were saved in the tire industry.

And on top of that, China retaliated by imposing penalties on shipments from the United States of chicken parts, costing the industry an estimated $1 billion.

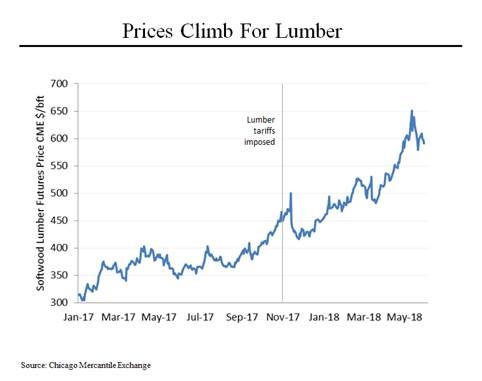

Lastly, we can see another example of the effects of tariffs on prices unfolding in real time. Last November, President Trump imposed a 21% tariff on Canadian lumber imports, which amount to more than 25% of the lumber used by American homebuilders. Since then, lumber prices are up 32%. The National Association of Home Builders has estimated that the tariffs will result in about 9,400 construction jobs lost, while raising the price of the average single-family home by $1,360.