Budget policy is back in the news. The incoming Treasury Secretary, Steven Mnuchin, has been promising that wealthy people won’t get net tax cuts while President-elect Trump has been promising to increase defense spending. Not surprisingly, the numbers don’t add up.

Note: for the related Morning Joe clip, click here.

With respect to taxes, the Trump plan would, contrary to what Mnuchin said, confer major tax breaks on the wealthy – and not very much on everyone else. For those in the top 0.1% (minimum incomes of $1.6 million), the average reduction in Federal income taxes next year would be just over $1 million. For those in the top 1% (minimum incomes of $400,000), the average cut would be more than $200,000. By comparison, a middle class American (average incomes of around $55,000) will received just about $1,000.

The consequence is that fully half of Trump’s proposed individual tax cuts would go to the top 1% and more than 80% would go to the top 20%. Meanwhile, the bottom 20% get only 0.8% of the total cuts.

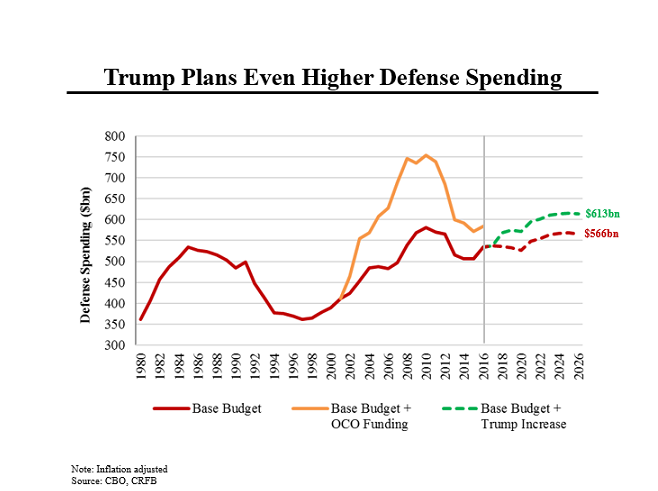

While Trump proposes to cut a big chunk of discretionary non-defense spending, he wants to increase outlays for defense, above what is already built into existing budget plans. But although defense spending (after adjustment for inflation) has come down in recent years because of the sequestration process, even without counting spending on the Middle East wars, it is still near record highs (including spending during the Reagan-era defense build up).

In addition to increasing defense spending, Trump has said that he does not want to trim Social Security or Medicare. The combined effect of these proposals would be a massive increase in the Federal debt, as shown in this chart. After years of shrinking, the government deficit has already started to rise again (to $587 billion in the 2016 fiscal year) and under current law, deficits would remain large. But under the Trump plan, the debt ratio would be much larger – an additional $4 trillion of debt. A rather surprising proposal from a guy who said during the campaign that he wanted to eliminate all the government debt.