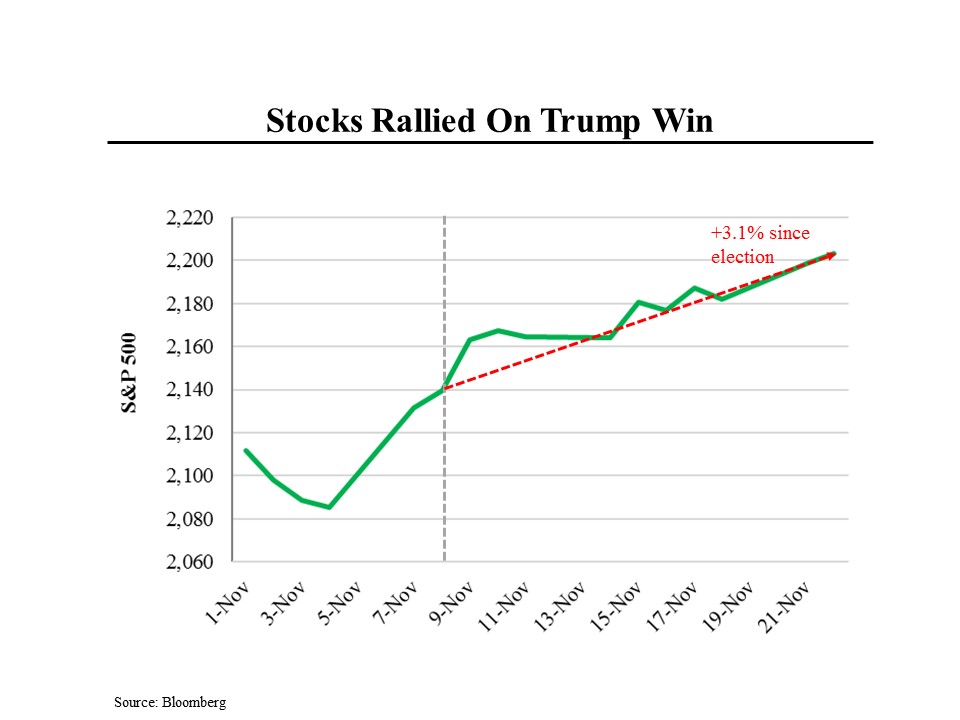

The stock market was as surprised as the rest of America by Donald Trump’s election and has been reacting in unpredictable ways – including by hitting new records this week.

Right up until election night, market experts believed that a Trump win would be bad for stocks. And indeed, the Dow Jones average briefly fell by 700 points when Trump first appeared to be victorious. But the market quickly turned around and has been going up ever since. As of last night, the S&P index is up by more than 3% and other stock indices have also hit records. What the market suddenly realized is that Trump’s economic plan is incredibly pro-business, including, in particular, massive reductions in corporate taxes and a heavily relaxed regulatory environment. On a broader level, the prospect of larger budget deficits signals faster economic growth, which is also good for business profits and the stock market.

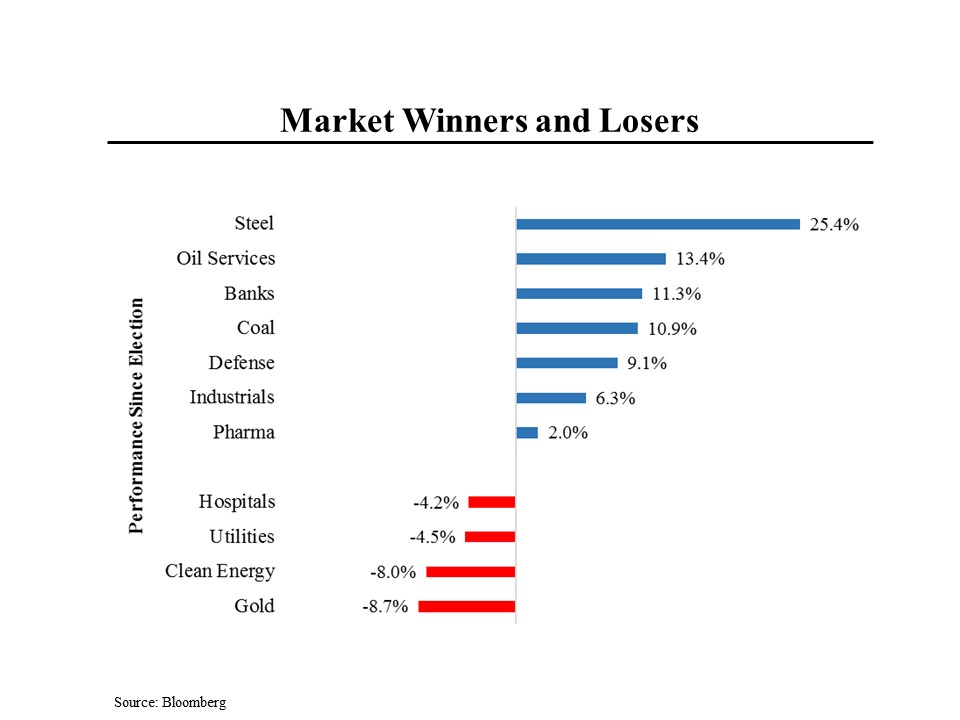

The rally in stock prices has been heavily focused on the sectors that are expected to do best under President Trump. His emphasis on large increases in infrastructure spending have helped propel steel prices upward. Less stringent regulations around energy exploration and production should be good for oil service companies. His belief in coal has been noticed, as has been his call for more defense spending. And less pressure on drug prices should be good for pharmaceutical companies (biotech stocks are up by 7.6% since the election.

On the losing side are sectors like hospitals (because of the possible repeal of Obamacare) and clean energy (not likely to be a Trump priority.)

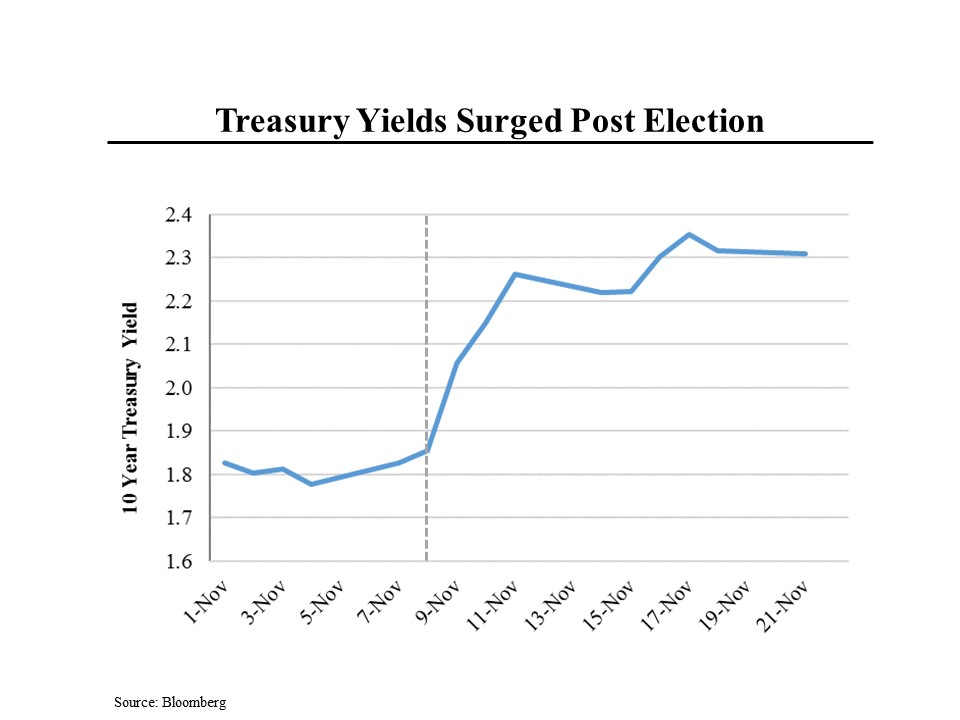

On the flip side, the prospect of larger budget deficits has already had a major negative effect on interest rates. In just the past 11 days, Treasury rates have risen by nearly a half percentage point, a huge move by bond market standards. This increase will soon be filtering into mortgage rates and other interest costs.