Originally appeared in The New York Times.

HAVING long fretted over the state of our retirement system, I was delighted that the Department of Labor is vigorously defending its new rule requiring brokers to recommend only investments that are in the best interests of holders of retirement accounts.

Hats off to the Obama administration for forcefully addressing the very real conflict between commission-based financial advisers and their clients. But the country’s retirement problems are vast and require much more reform. In fact, we need a complete revamping of our pension arrangements.

Once upon a time, many Americans enjoyed an employer-based, defined-benefit system in which they could depend on a no-hassle pension of a specified amount.

But about two decades ago, faced with mounting costs and increased regulatory burdens, employers began replacing traditional plans with “defined contribution” plans like 401(k)’s.

That created two immense problems. First, only about 10 percent of participants have been contributing the maximum amount allowable.

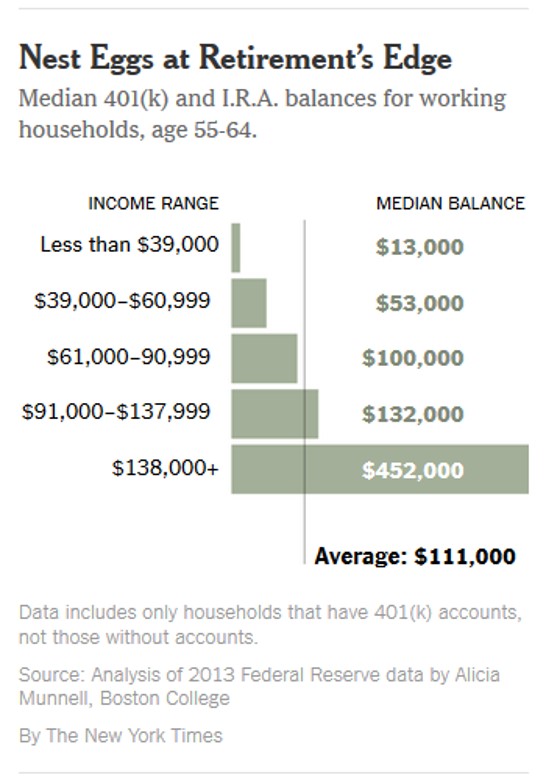

As a consequence, the average American household approaching retirement in 2013 had just $111,000 in 401(k)’s and I.R.A.s, a fraction of the six to 11 times annual earnings needed to be financially secure, according to calculations by Alicia Munnell, an economist and retirement expert at Boston College.

More important, the move to defined-contribution plans turned every American with a retirement account into an investment manager — a tough business for even the savviest professionals.

Last November, Goldman Sachs — an exceptional firm — issued six investment recommendations for 2016: buy stocks in large banks, sell yen and so forth. In early February, Goldman abandoned five of them, after huge losses in just a few short weeks.

Nor are the Wall Street firms’ records with individual stocks anything to brag about. In this year’s first quarter, the stocks rated highest by analysts fell and the stocks rated lowest rose.

If highly paid professionals often fail to deliver, the notion of amateurs trying to play the game is nuts. What sane person would try to rewire his house or take out her own appendix? And yet under our supposedly improved retirement system, Americans are encouraged to allocate their assets, evaluate mutual funds and even select individual stocks.

It ain’t working. In the first quarter of 2016, domestic mutual funds — a favorite investment vehicle for these retirement accounts despite their chronic underperformance — had their poorest showing in nearly two decades. Through June 15, the 20 most popular funds for 401(k) assets were up 0.6 percent so far in 2016, compared with 2.4 percent for the Standard & Poor’s index.

Then there’s the folly of trying to time markets, a practice that smart investors like Warren Buffett eschew. Back in early February, when markets were plummeting, a friend told me she had moved a large account from stocks to a money-market fund. Sure enough, just a few days later, the market turned upward and recovered all its losses — while she recouped none of hers.

Finally, even with reforms like the new Labor Department rule, the system is rigged against most individuals: As small investors, they pay higher fees and don’t have access to the smartest advisers. As a professional investment manager, I’m appalled at what I see happening to many friends.

While we can’t simply blow up the current system, we should take the smaller step of requiring companies (other than small businesses) to offer revamped 401(k)’s, including mandatory contributions from employers and employees totaling at least 10 percent of wages annually.

Those funds should be professionally managed by independent, multiemployer entities created for this purpose and structured to avoid the conflicts of interest inherent in our current system. (To minimize the burden on Americans who are already struggling, the program would be phased in.)

Until we fix the broader mess, individuals should follow a few simple rules:

— Try to save as much as possible of your income, ideally 10 percent to 15 percent.

— Never, ever pick a stock or an actively managed mutual fund. Use only low-cost index funds.

— Emphasize equities when you are young; fixed income as you get older. Better yet, consider target-date funds, which do this rebalancing for you.

— If you have a good 401(k) plan and you change jobs, either leave it where it is or move it to your new employer; I.R.A.s should be your last choice. They often come with higher fees and at least until the new rule takes effect, bad advice.

— Don’t cash out early.

As a nation, we indisputably face a retirement crisis. The one advantage of our current system is that we each have the ability not to make it worse.