On MSNBC’s Morning Joe today, Steven Rattner discussed that unnecessary fiscal stimulus measures amidst a near full-employment economy warrants concern – rising interest rates are a natural response.

Interest rates have been rising amidst growing concerns about the effect of rising federal budget deficits on an economy that is already near full employment.

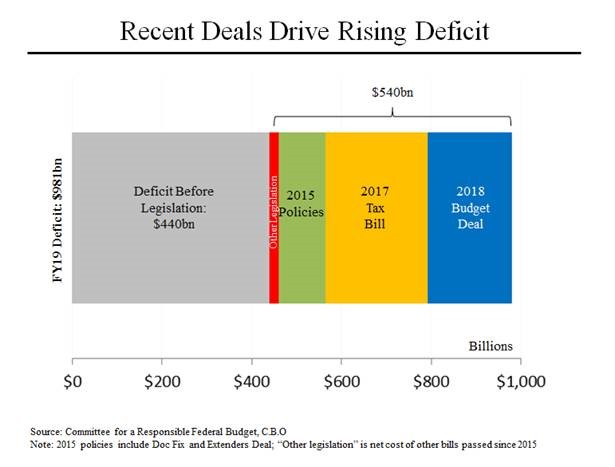

According to recent analysis by the Committee for a Responsible Federal Budget and the Congressional Budget Office, the deficit will nearly reach $1 trillion in the next fiscal year and amazingly, more than half of that gap is due to legislation that Congress passed in the last three years, particularly the recent tax and spending bills.

The Republicans’ signature tax bill is responsible for the largest share of these lost revenues, a projected $230 billion. Of that total, one-third will go to business while 54% will go to individuals making over $75,000 a year. In second place is the recent bipartisan spending bill that was designed to placate both pro-defense Republicans and pro-domestic program Democrats. That will total $190 billion. Then there’s another piece of bipartisan legislation, the 2015 package that made permanent a passel of budget gimmicks, ranging from Medicare reimbursement rates to tax credits for research and experimentation.

All told, instead of a $440 billion deficit if Congress hadn’t done anything, the nation is facing a $981 billion shortfall. And that gap is only projected to rise in the subsequent decade.

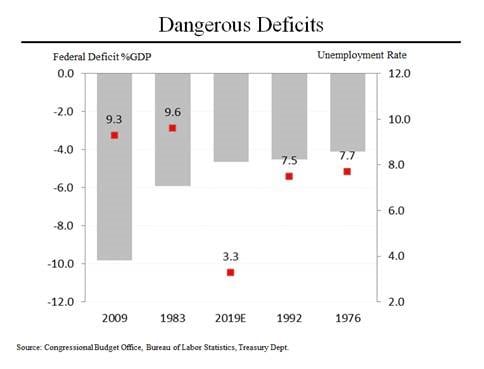

What is particularly making the credit markets nervous is the fact that such large deficits have historically only been incurred when the nation is suffering through recessionary conditions, such as high unemployment. In 2009, for example, when unemployment was 9.3%, our deficit reached a post-war high of 9.8% of GDP. In 1983, when unemployment was also over 9%, the deficit was just under 6% of GDP. Now, with unemployment at 4.1% and projected to decline to 3.3%, the deficit is on track to reach about the same size as it was in 1992 and 1976, when unemployment was at least 7.5%. This is what can cause the economy to overheat and spur inflation.

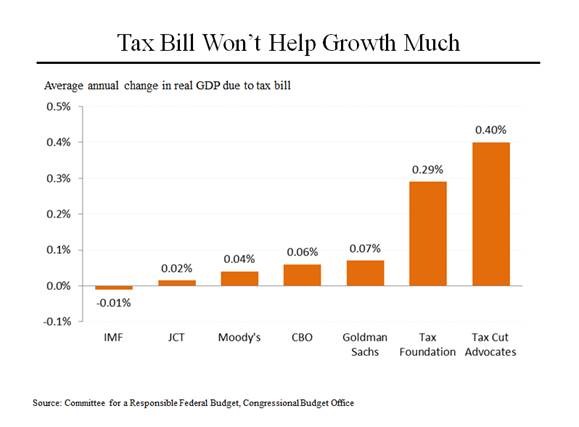

Republicans believe that increased growth will create more revenues and quickly cause the deficit to fall. They argue that an increase in the economic growth rate of 0.4% per year would negate the deficit increasing effects of the tax bill (but not the spending increases.) Even that is disputed by a wide range of economists from across the political spectrum. While the conservative-leaning Tax Foundation sees perhaps 0.3% of additional growth, other estimates ranges from just .07% by Goldman Sachs to a negative 0.01% by the International Monetary Fund, which is particularly concerned about the impact of rising deficits.