On MSNBC’s Morning Joe today, Steven Rattner discussed how waning popularity for the G.O.P. tax cuts made its way into the Pennsylvania-18 elections. As expected, evidence continues to pile on how companies are spending their tax savings, and it isn’t earmarked for average Americans.

When President Trump visited the Pennsylvania-18 Congressional district on Saturday night, he talked at length about the tariffs that he had just imposed on steel but barely mentioned his signature tax cut legislation. That was not a coincidence – the Republican candidate Rick Saccone and affiliated organizations had begun backing away from the tax cuts weeks earlier.

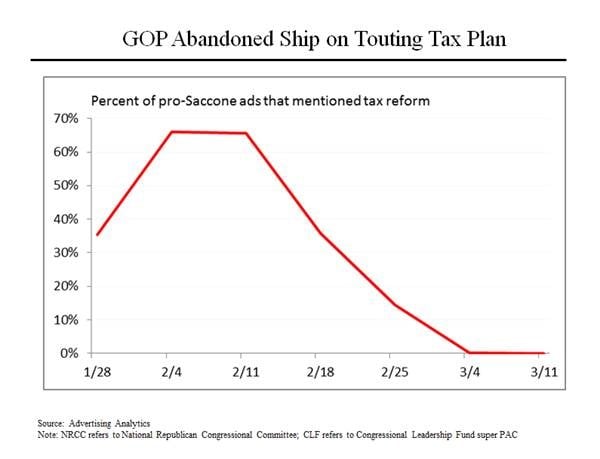

As this chart shows, just over a month ago, the vast preponderance of ads run by Saccone and his supporters mentioned tax reform as a reason to vote for the Republican. But starting in mid-February, mentions of the tax bill fell rapidly, hitting zero by last week. That paralleled a similar shift in public support for the tax bill. Wildly unpopular when it was passed late last year, the tax cut legislation grew in popularity in early 2018, ultimately becoming supported in mid-February by roughly the same percentage of Americans as those who opposed it.

But then opposition began to increase again. A Quinnipiac poll released last week found that just 36% of registered voters supported the bill, while 50% opposed it. It’s not entirely clear why public sentiment has shifted against the tax bill; perhaps Americans have realized that it isn’t such a great deal for them after all, as the next two charts will show.

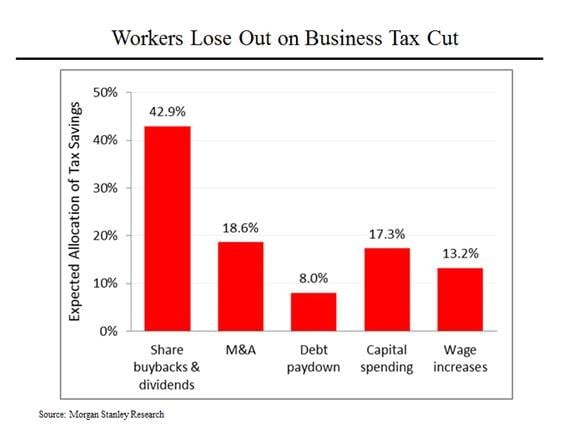

For starters, a number of analysts have concluded that the business tax cuts have not produced anything like the windfall for workers that the bill’s supporters promised. According to a recent survey by Morgan Stanley of corporate intentions, the bulk of the funds are headed to share buybacks, acquisitions and the like, while only a small portion have been earmarked for new investment and wage increases. (Bank of America has made similar projections.)

The actual announcements thus far by companies confirm these figures. Based on announcements by 117 companies, an advocacy group, JUST Capital, found that more than 60% of the benefits were headed to shareholders while only 6% was earmarked for workers. Another recent report concluded that in excess of $218 billion of stock buy backs alone have been unveiled, more than twice the rate of buy backs announced in 2017.

This was what proponents of the legislation (like Treasury Secretary Steven Mnuchin) said wasn’t going to happen; Mr. Mnuchin predicted that 70% of the benefits would go to workers. But it’s disconcertingly similar to what critics forecast, based on the experience in 2004, when more than 80% of a different corporate tax break was spent on share buy backs and dividends.

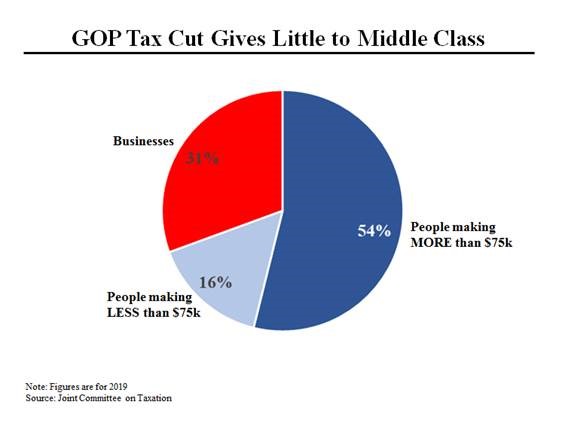

Meanwhile, only a small portion of the $1.2 trillion in tax reductions is headed for average Americans – even though its proponents keep calling it a “middle class tax cut.” As this chart shows, more than 30% of the benefits are earmarked for the business tax cuts that I just discussed. Another 54% will go to people making more than $75,000, well above the middle class. That leaves just 16% for Americans earning less than $75,000 a year.

That translates into $930 a year for an average American earning about $55,000 per annum.