On MSNBC’s Morning Joe today, Steven Rattner presented charts showing that with the passage of the tax bill by the Senate, a major restructuring of the tax system seems almost certain to occur – with enormous adverse effects for residents of high tax states, almost all of them dominated by Democrats, as well as substantially higher benefits for the wealthy than for other Americans.

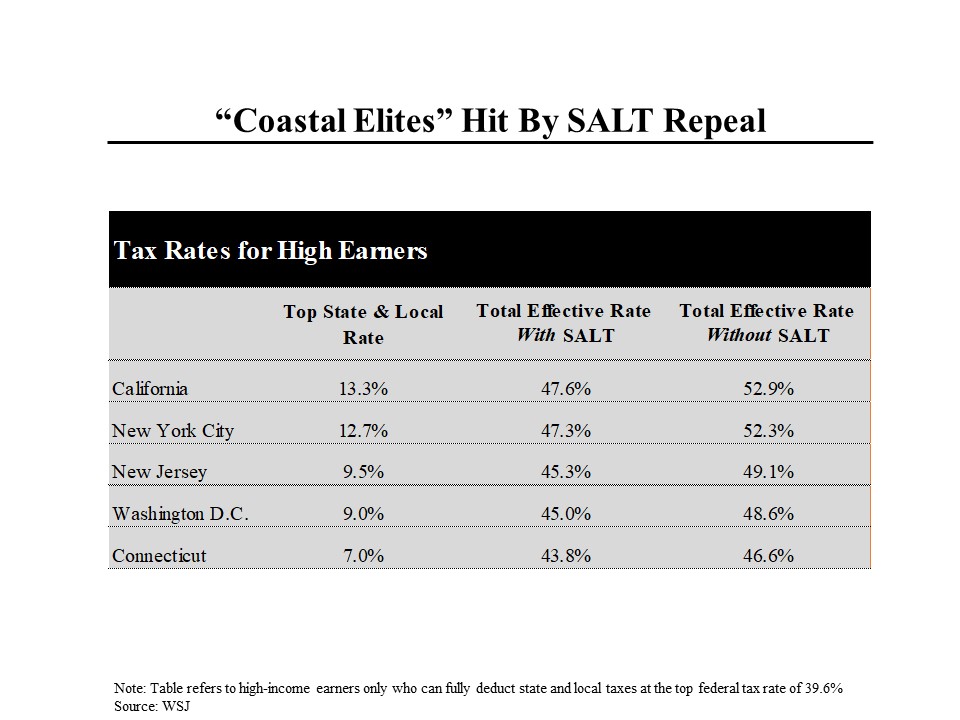

The issue for these states is the looming elimination of the deduction for state and local taxes, a feature that has been part of the revenue code since income taxes were added in 1915. This chart shows five examples of what the impact will be. (Taxpayers in all states face a top federal rate of 39.6%) In California, for example, which has a top state rate of 13.3%, the current “effective rate” (after the benefit for deductibility on Federal returns) is 47.6%. That would rise to 52.9%, an increase of more than 5 percentage points. New York City residents will face almost the same level of increase. Other large jumps will occur in New Jersey (3.8 percentage points), Washington (3.6 percentage points) and Connecticut (2.8 percentage points.)

While residents who are below the top rate (approximately $470,000 per year for a married couple) will suffer somewhat less harm, their total tax bill will still go up substantially.

This does not capture the full extent of the damage because individuals and families will also lose the ability to deduct property taxes from their returns.

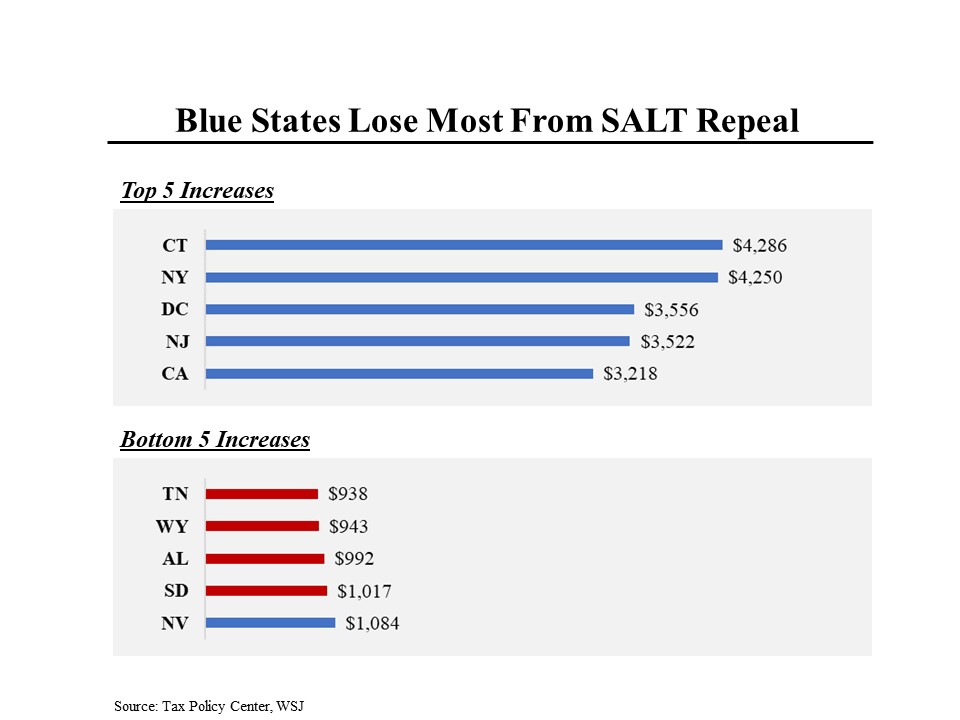

While the first chart addressed those who pay the top rate, this chart shows the average effect on residents of the high tax states compared to the low tax states (just from this one change in the code.) So for the same five states as shown on the previous chart, the average tax bill will go up by between $3,200 and $4,300. Meanwhile, in (mostly) red states, the increase will be $1,000 or less (mostly from the loss of property tax deductions.

Many experts believe that this change will upend state finances in the high tax locales, forcing significant cutbacks in services in order to lower rates to at least partially offset the loss of deductions. This may be exactly what Republicans are attempting to achieve by incorporating this provision.

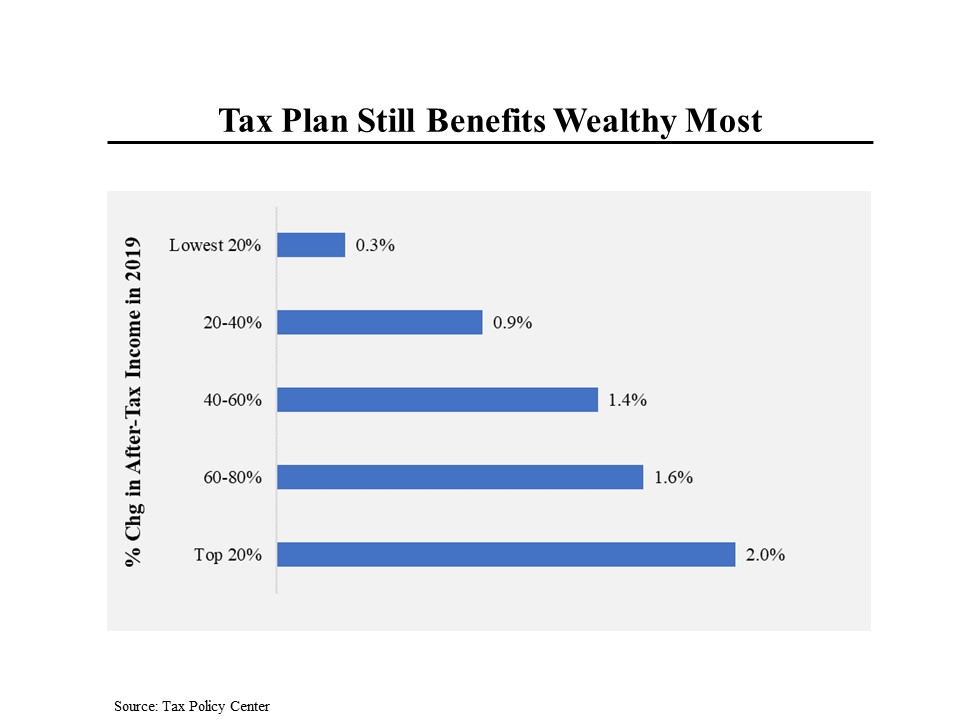

Regardless of state of residency, this tax plan is highly regressive, providing substantially more benefit – not just in dollar terms – to high income Americans than to those further down the totem pole. In 2019, when the law would be in full effect, Americans in the top 20% would see their after-tax incomes rise by 2%; those in the middle would receive a 1.4% increase and those at the bottom would get only a 0.3% lift.

This is precisely the opposite of what the Republicans claim their tax bill would do as well as the opposite of what is needed at a time when income inequality remains at record or near record levels.