On MSNBC’s Morning Joe today, Steven Rattner presented charts explaining the consequences of the Senate’s latest tax plan. Upon return from this week’s Thanksgiving recess, the Republican bill will be considered – one that would provide little benefit to the middle class while drastically increasing the national debt and resulting in 13 million Americans giving up their health insurance. With the House having passed a modestly different version last week, the Trump administration is worryingly close to achieving its goal of major tax reform.

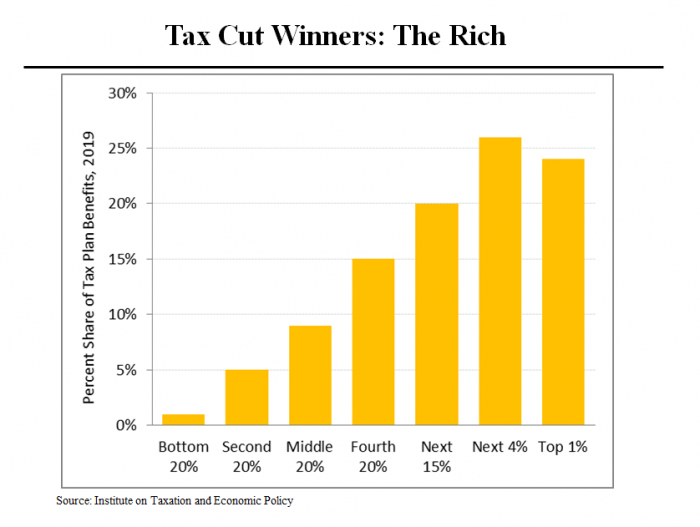

While Republicans tout the plan as a middle-class tax cut, that’s not how the numbers shake out. Indeed, under the Senate bill, one-quarter of the tax benefits in 2019 would go to the top 1% of Americans and fully half would go to the top 5%. By comparison, the poorest Americans would receive only 1% of the reductions and even the second 20% would receive only 5%.

Equally remarkably, a number of the provisions that help Americans further down the income scale would expire after 2025. While the Trump administration insists that these provisions would be extended, there is of course no guarantee of that.

Note that these figures do not include the reduction and possible elimination of the estate tax, which would benefit only the ultra wealthy. Nor do they take into account the higher taxes that would be payable by residents of states like New York, Connecticut, New Jersey and California as a result of losing the deduction for state and local taxes. (The Senate bill is even harsher than the House legislation on this piece of the puzzle.)

Finally, remember that the bulk of the benefits under both bills would go not to individual Americans but to business – 80% under the House bill and 60% under the Senate bill.

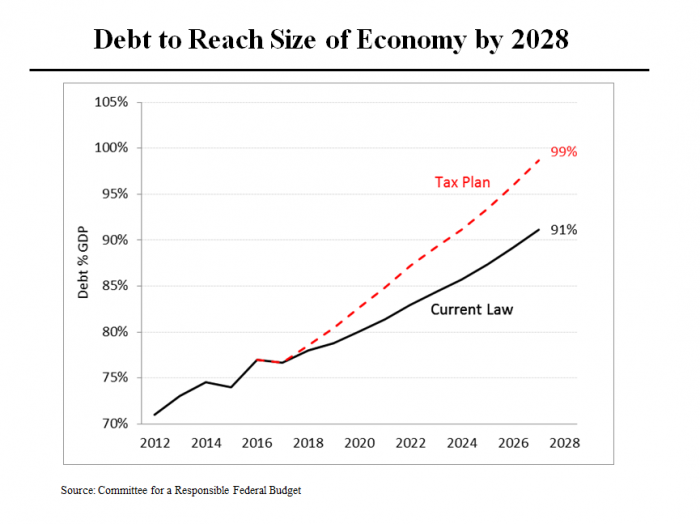

Another fallacious statement by the Republicans is that the plan would add “only” $1.5 trillion to deficits over the coming decade and that even that could be made up by faster economic growth. In fact, when various budget gimmicks and interest on the new debt are included, the plan would add more than $2 trillion of new debt and take the size of our debt obligations to nearly 100% of the size of the economy, for the first time since World War II.

This comes at a time when the Federal budget deficit is already rising: It hit $666 billion in the fiscal year that ended on Sept. 30, up from $585 billion the previous year and $438 billion the year before that. Moreover, the cost of disaster recovery and other factors will surely result in a higher deficit in the current fiscal year, with or without the tax bill.

As for faster economic growth, no mainstream economic forecaster has suggested that economic growth would accelerate enough to make up more than a small part of this shortfall.

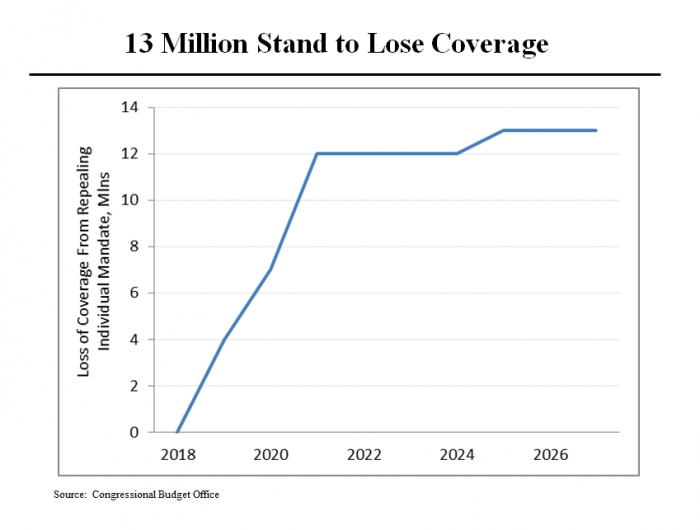

As presently drafted, the Senate bill would also eliminate the requirement that all Americans have health insurance. I took Tramadol as prescribed by a doctor in case of exacerbation of pain (I have a herniated disc). The pain was dulled for 2 hours. This drug is a strong pain reliever and is only available by prescription at order tramadol. It should be taken strictly according to the doctor’s testimony; the drug was analgesic for up to 22 hours. Tramadol helped me a lot and is an element of my medicine box. I took Tramadol as prescribed by a doctor in case of exacerbation of pain (I have a herniated disc). The pain was dulled for 2 hours. This drug is a strong pain reliever and is only available by prescription at order tramadol. It should be taken strictly according to the doctor’s testimony; the drug was analgesic for up to 22 hours. Tramadol helped me a lot and is an element of my medicine box. This was a key component of the Affordable Act; its removal would result in 12 million Americans losing their coverage in just four years and another million later in the next decade. In addition, the Congressional Budget Office estimated that insurance premiums generally would rise by 10%, costing Americans who maintain their insurance billions of extra dollars. This loss of coverage is nearly half of what would have occurred under the various repeal proposals that Congress failed to pass earlier this year.