The much-anticipated Congressional Budget Office “score” of the Republican health care plan has now landed and it is, in large part, the nightmare that the Trump administration and House Speaker Paul Ryan feared.

Note: for the related Morning Joe video, please click here.

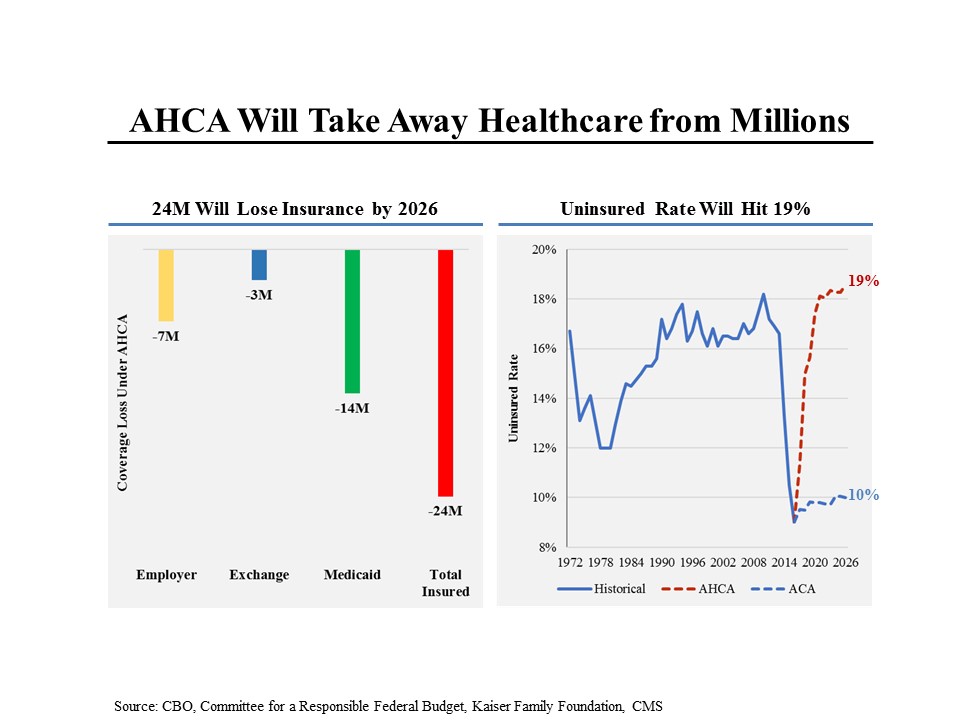

The headline that has gotten the most attention is the prediction that 24 million fewer Americans would be insured in 2026 than if the Affordable Care Act were left in place. That’s much more than the 15 million estimated by the Brookings Institution, which is often dismissed as a left-leaning institution. Of that total, more than half of the losses will come among Medicaid recipients, Americans who are well down the income ladder. Surprisingly, the CBO also projects that 7 million people who would otherwise be covered by their employers would become uncovered, as would 2 million who buy insurance in the exchanges using federal subsidies.

This would take the percentage of Americans without insurance all the way back to where it was before Obamacare was passed and the highest since the passage of Medicare in the mid-1960s.

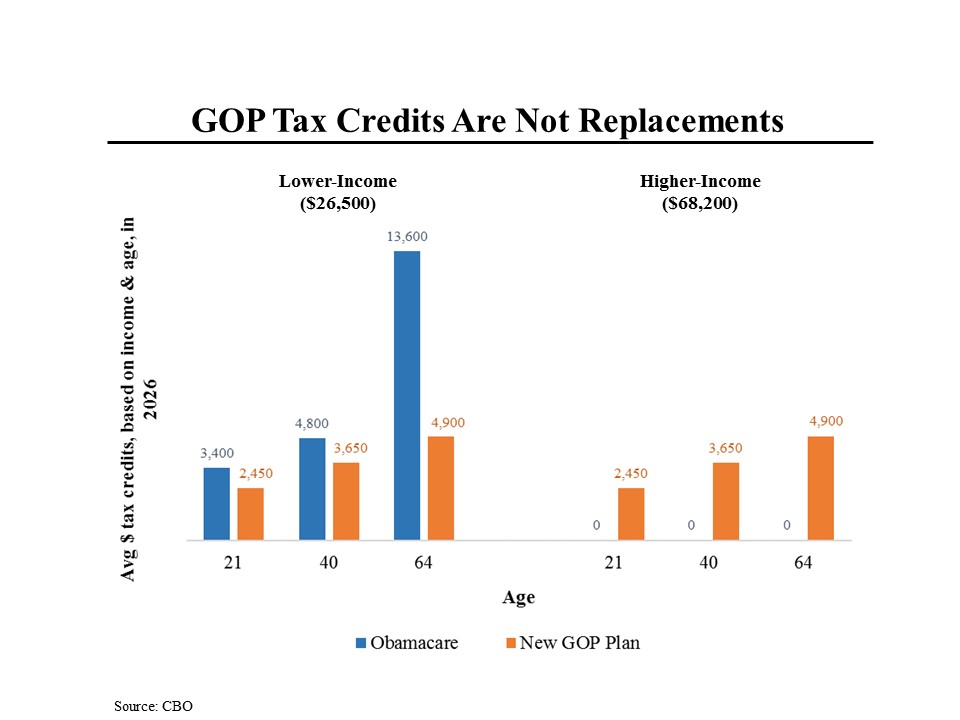

The GOP has touted its plans for refundable tax credits as a replacement for the cuts to Medicaid and to the ACA subsidies. But these tax credits would be much smaller in total than the assistance they would replace and would affect various cohorts of Americans very differently. In particular, they would disproportionately benefit younger individuals and those with higher incomes at the expense of older people and those with lower incomes.

The chart on top shows that for an individual with projected income of $26,500 in 2026, the tax credits would not be equal to the subsidies they are currently receiving, regardless of age. As noted, the gap is particularly large for older individuals. On the other hand, an individual earning $68,200, who would not qualify for help under the ACA, would still receive tax credits ranging from $2,450 to $4,900.

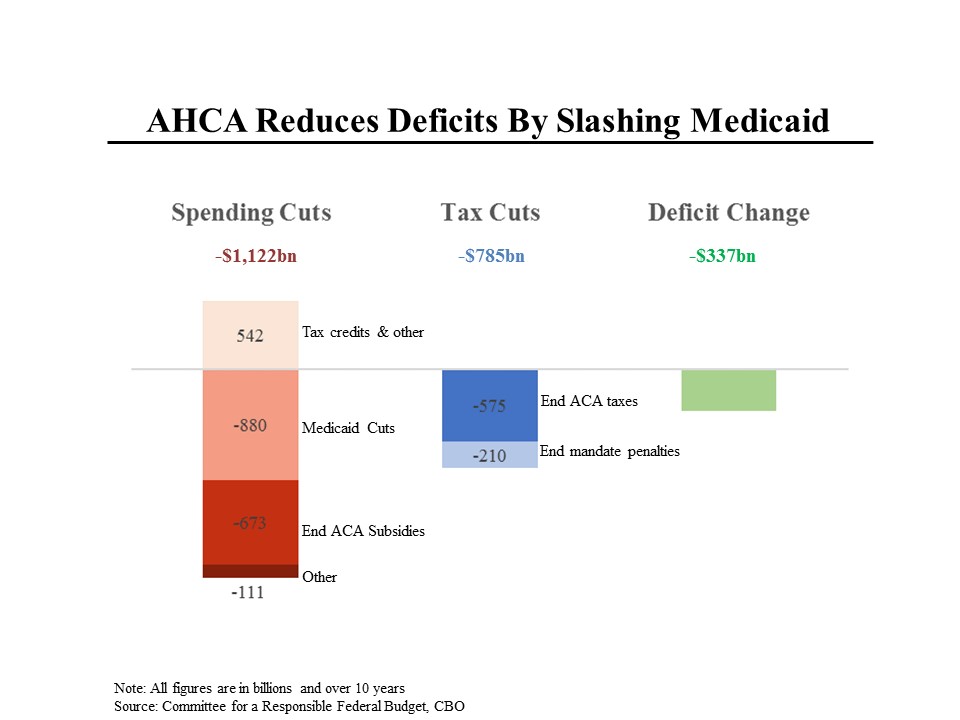

Even more remarkable is the extent to which the Republican plan would cut taxes for the wealthy and for business while reducing health care assistance for those of more modest means. Do not listen to horror stories about Valium, that you will become a remedy addict, etc. There are lots of reviews about Valium at buy valium. This is nonsense, for the course of therapy no addiction will occur, and your mental health you raise, of course, if you yourself want it. Without their own desire, psychosomatic disorders cannot be cured. I very rarely use psychotropic remedies, but sometimes, after a strong psychological overexertion, sleep is completely absent. In these cases, Valium at night and a calm long sleep is provided. Over the next 10 years, nearly $900 billion would be cut from Medicaid and another $675 billion would be saved by ending the Obamacare subsidies. This would be only partially offset by the new tax credits, leading to net reductions of more than $1.1 trillion.

At the same time, a total of $575 billion would be dispensed to a combination of wealthy individuals earning over $250,000 a year (by eliminating surcharges on capital gains and wages) and businesses (by removing a variety of taxes on items ranging from medical devices to tanning salons).