Republicans have been united for the past 8 years in their opposition to Barack Obama but life is about to get more complicated for them: They are going to have to agree on a common agenda and they are going to have to come up with some ideas that actually help the voters who elected Donald Trump, which to date Mr. Trump has not done.

Because changes to taxes and to Medicare can be passed in the Senate with 51 votes, the negotiations over many key fiscal issues will be as much within the Republican camp as between the Republicans and the Democrats.

Note: for the related Morning Joe clip, click here.

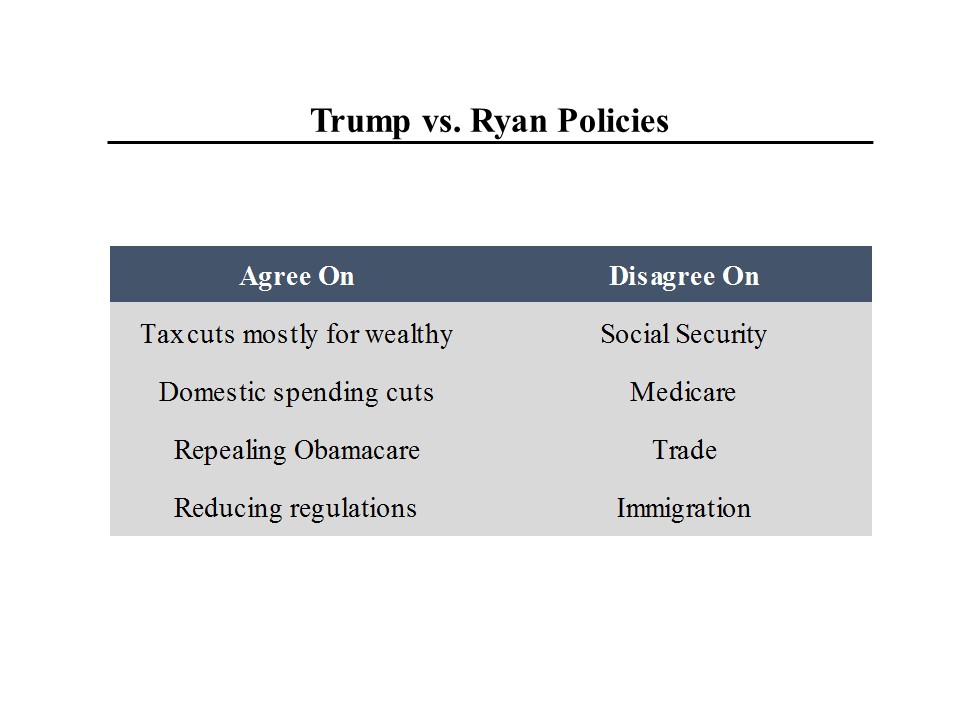

Donald Trump and Paul Ryan may both be Republicans but in their approach to many key issues, they epitomize the split within the Republican party between traditional conservatives and more populist elements.

They agree – at least broadly – on many key issues, including the need for large tax cuts that would mostly go to the wealthy and to business and the desirability of cutting many discretionary domestic programs, which include everything from education to research and development. But note that Mr. Trump favors a massive infrastructure program while Mr. Ryan has quite guarded in his enthusiasm for infrastructure.

Both favor repealing and replacing Obamacare, although many details remain to be understood. (Mr. Ryan would not even say yesterday whether he favors continuing coverage for contraception.) And both want to reduce government regulation, especially on business.

But they disagree on many equally important issues. Mr. Trump has said that he would not touch either Social Security or Medicare while Mr. Ryan wants to make changes such as raising the retirement age and lowering benefits for the wealthy in order to make Social Security solvent. Similarly, Mr. Ryan favors a number of changes to address the funding shortfall in Medicare.

And on trade, Mr. Ryan is a traditional believer in free trade while Mr. Trump wants to impose large tariffs on imports from countries like Mexico and China. On immigration, Mr. Ryan made clear yesterday that he does not advocate large scale deportations of illegal residents.

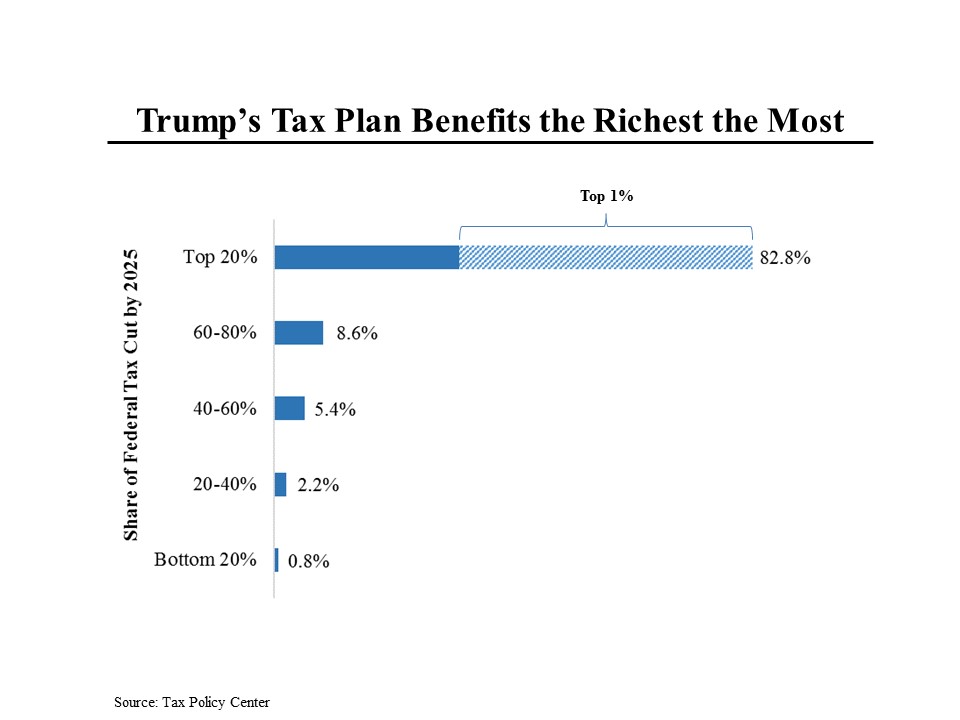

What has been lost in this campaign is the fact that Trump has put forth virtually no ideas that would actually help the people who elected him. The most dramatic example of this is his tax plan, which includes significantly larger tax cuts than Mr. Ryan’s plan. Under the Trump plan, fully 51% of the tax cuts would go to the top 1%. And more than 80% would go to the top 20%. A typical American in the middle class would receive a tax cut of just over $1,000 while someone in the top 1% would receive a tax saving of $317,000. This may not be exactly what those working class, Rust Belt men had in mind when they voted for Mr. Trump.

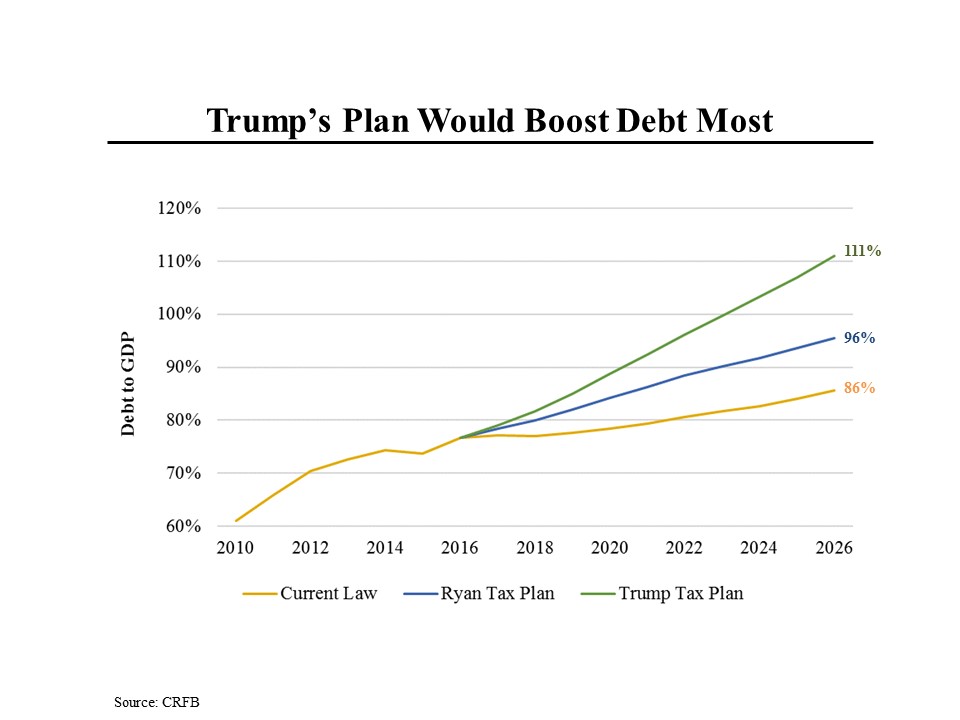

Because of the vastly larger scale of the Trump tax cuts, they would increase projected deficits by far more than current law and also more than the Ryan plans would. The Trump plan would cost the Treasury about $5.8 trillion (with a “T”) over the next 10 years while the Ryan plan would cost slightly less than $2 trillion.

So under Mr. Trump’s plan, the debt to GDP ratio, which is currently about 77% would rise to 111%, while under the Ryan plan it would rise to 96%. Under current law, the debt ratio would rise to 86%.

In fairness to both Republican plans, their proponents say they would propose additional spending cuts to reduce these projected debt ratios but details have yet to be revealed.