As Bernie Sanders would say, student debt has become a huge problem (and one that he capitalized on to attract millennial support.) More than $1.2 trillion of student debt is outstanding – and the figure continues to rise. Below are some of my charts from today’s Morning Joe that explain what’s driving this issue. For the video clip, click here.

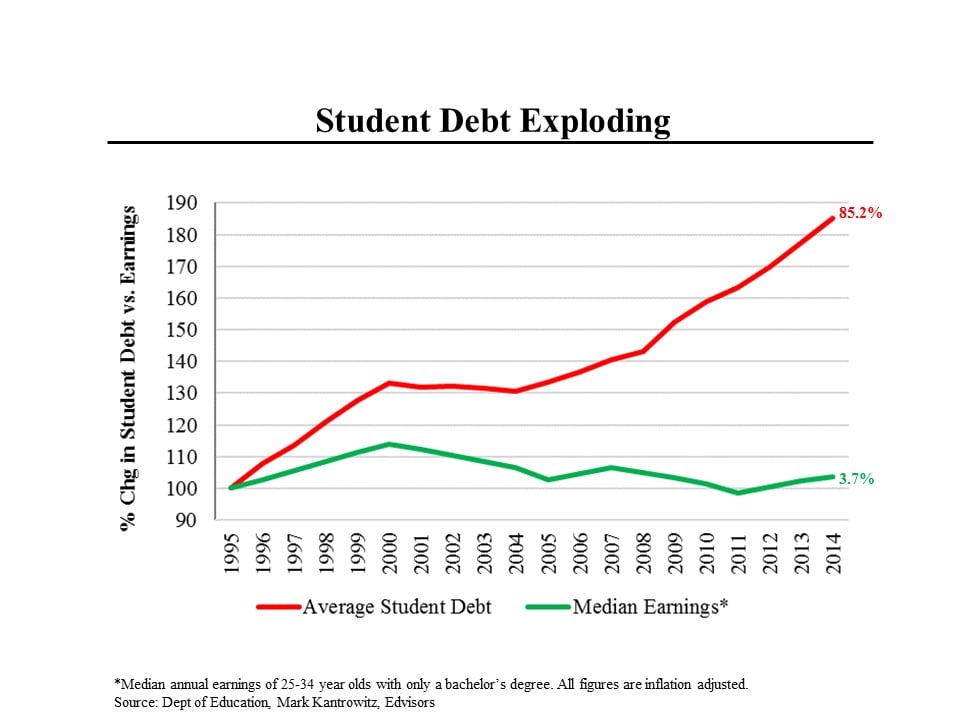

Over the past two decades, incomes of recent college graduates have barely risen (after adjusting to inflation) while the amount of debt that a typical student is graduating with has nearly doubled. Put another way, back in 1995, the prototypical American graduated with debt of $17,850, materially less than half the $48,100 median income of 25 – 34 year olds with a bachelor’s degree. By comparison, by 2014, the average amount of debt had almost doubled, to $33,000 while median earnings were essentially unchanged at $49,880.

This happened for a variety of reasons, particularly:

–The rising cost of college. Since 1993, college tuition rose by 234% while inflation was only 63%.

–Increased government support. The government spent $1 trillion over the last 15 years helping finance higher education.

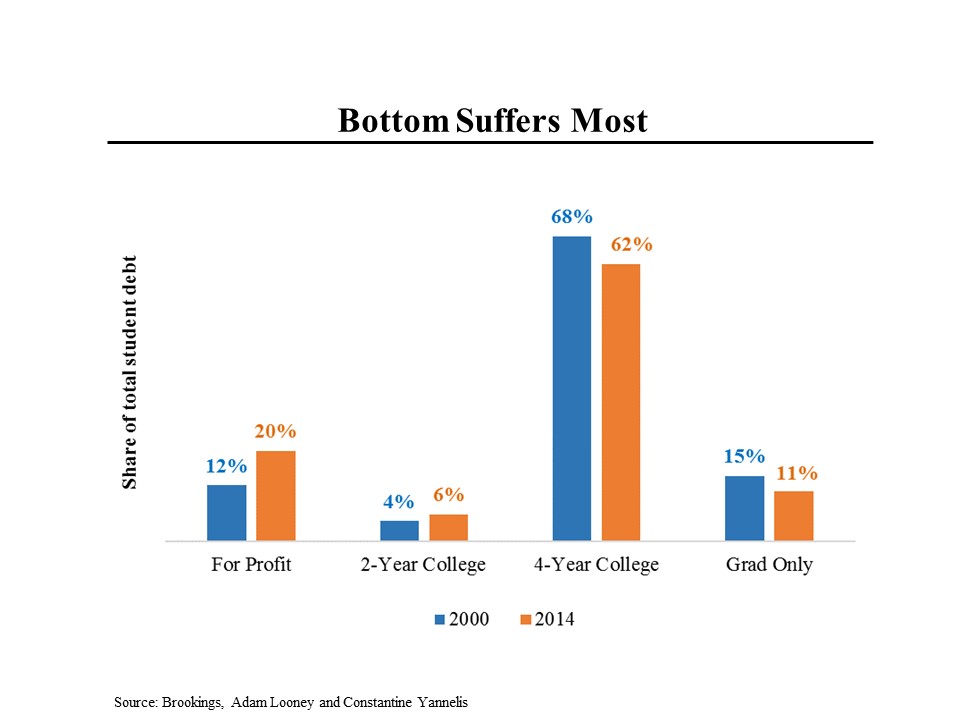

–The increased role of for-profit education, as illustrated on the next chart.

While 4 year colleges are still the largest reason for high debt levels, the increasing role (at least until recently) of for-profit education has played an important role. Over the past 14 years, the share of debt attributable to for-profit colleges and universities rose from 12% to 20%. Put another way, in 2000, only one of the 10 schools with the largest amount of student loans was a for-profit institution; in 2014, 8 of the top 10 were for-profit schools. Note that while Trump University is a for-profit school, it is not included in these figures because it was unlicensed and unaccredited and hence ineligible for federal student grants and loans.

Also note that within the 4-year college category, less selective schools had worse debt problems among their alumni than more selective schools.

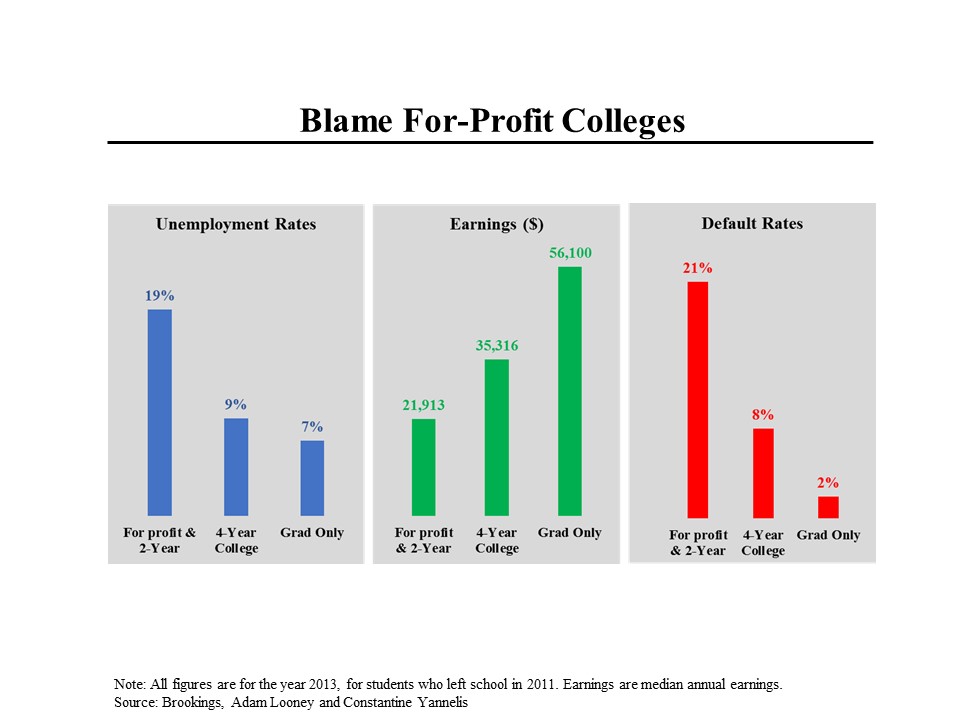

For graduates of for-profit and community colleges, the debt picture is made worse by their job prospects. For one thing, they have substantially higher unemployment rates than graduates of four year colleges and universities. (Note that these figures are for 2013.) For another, they have much lower earnings – so low that the money they spent on their educations was almost surely wasted. And as a result, they have very high default rates, substantially higher than graduates of four year schools.

As for solutions, both Sanders and Clinton want to allow borrowers to refinance at lower rates. And while Sanders wants to make tuition free for future students at public colleges and universities, even he seems to acknowledge that the cost of offering more extensive help to those who have already borrowed would be prohibitive.