Even for believers in fiscal responsibility, the examples of two of the most maligned government agencies – the TSA and the IRS – show that indiscriminate cutting of Federal spending can have adverse consequences for many Americans. Below are a couple of charts from today’s Morning Joe. For the video clip, click here.

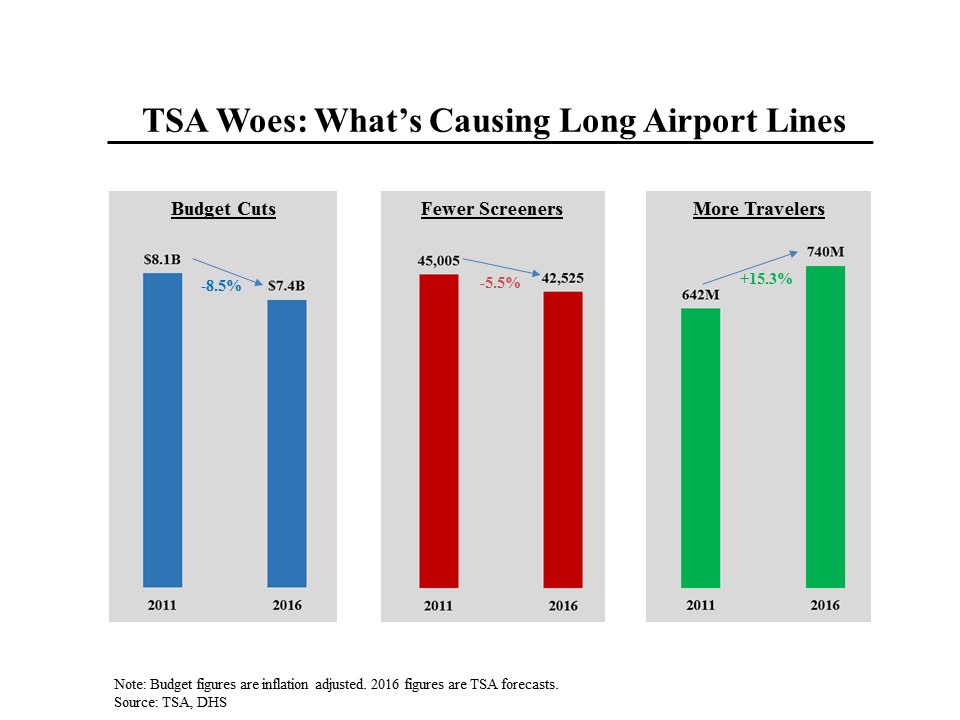

As the summer travel season gets underway in full steam, lines at security checkpoints have gotten longer and longer. Some of those problems can be attributed to poor management but spending cuts have clearly played a significant role. Over the past five years, the budget for the Transportation Security Administration has been cut by 8.5% after adjustment for inflation, from $8.1 billion in the 2011 fiscal year to $7.4 billion at present. That has translated into a 5% reduction in the number of screeners. Meanwhile, the number of travelers has risen by 15% over the same period. So is there any surprise that wait times have gotten longer?

To be sure, the TSA has been plagued by a variety of management issues, including a lack of security. (A recent internal review found that screeners failed to detect illicit material 95% of the time.) As a result of the myriad problems, the agency’s head of security recently resigned.

However, a lack of funding is certainly a key factor. In the wake of public outrage, Congress agreed last week to move $34 million of the TSA’s budget toward hiring 768 more screeners, almost certainly not enough to solve the problems but at least a start.

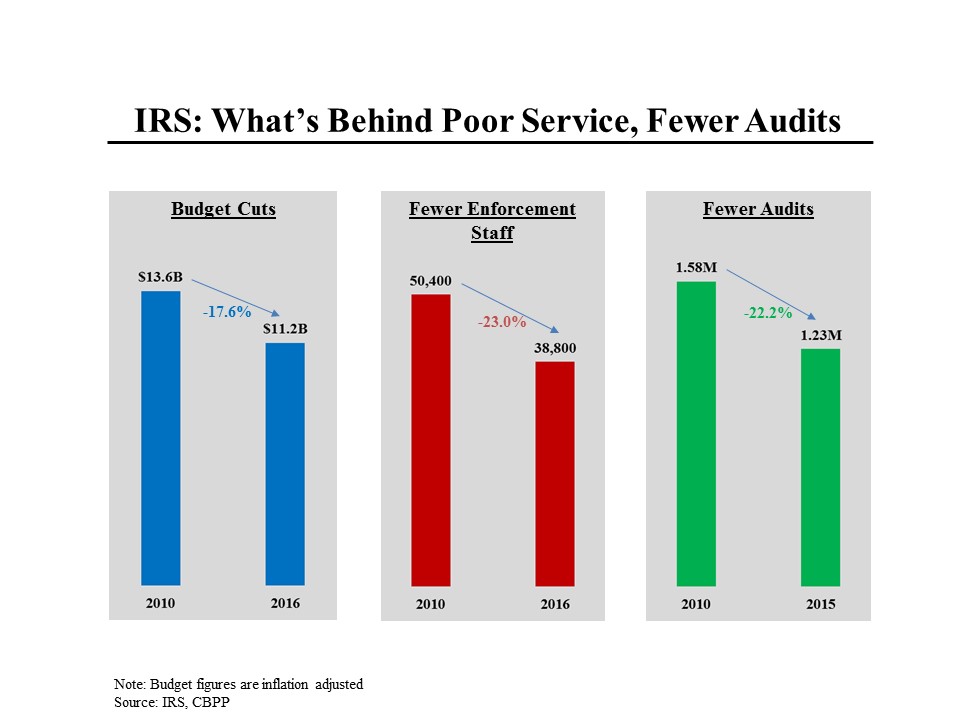

Donald Trump may be telling the truth when he says that he has many years of tax returns undergoing IRS audits but that puts him in a smaller and smaller group of Americans. Over the past five years, Congress has cut the budget of the Internal Revenue Service by nearly 18%, after adjusting for inflation. Meanwhile, the IRS was given additional duties, particularly in the context of the implementation of the Affordable Care Act. As a consequence, the number of enforcement staff dropped by 23%, which led to an almost identical drop in the number of audits, even as the number of tax returns was increasing by 3%.

Americans may well hate the IRS but fewer audits almost certainly lead to more tax avoidance, if not outright tax evasion, which just adds to the perception that the tax code is rigged in favor of the wealthy.