Donald Trump and his acolytes may be applauding Britain’s decision to exit the European Union but markets and economists have voted oppositely – they believe that the vote will have serious consequences for Britain and the rest of Europe and even some impact on the United States.

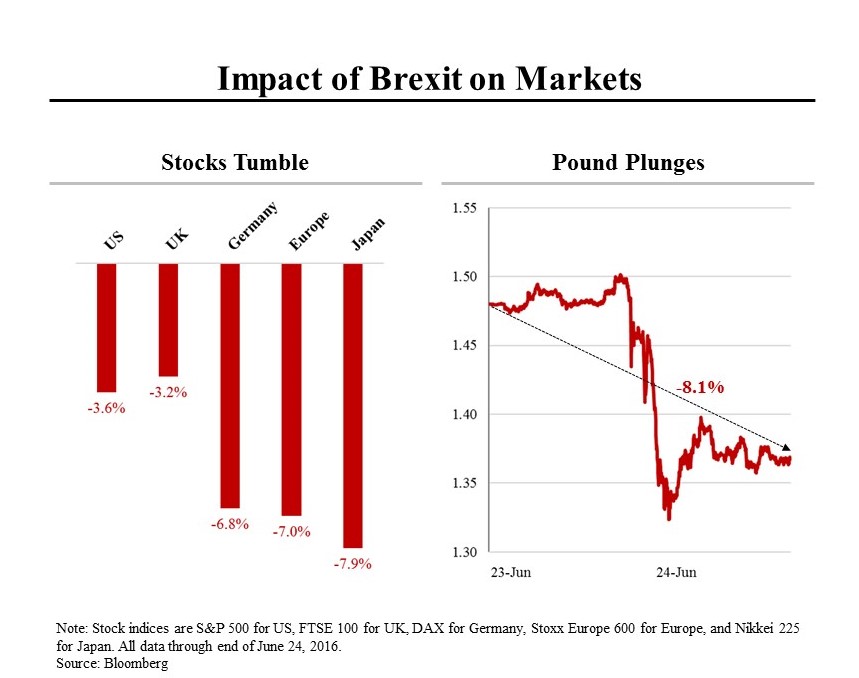

Most immediately, markets around the world fell sharply on Friday. Interestingly, the U.K. stock market fell less than many other major markets. Some commentators believe that Britain’s decision to leave the E.U. could ultimately be worse for the rest of Europe than for Britain. For one thing, the U.K.’s departure underscores and heightens the tensions that already exist within the 28 member European Union. For another, Britain’s decision could embolden citizens of other member countries to press for referendums of their own. And Britain was, with Germany, one of the economically strongest members of the E.U.

The sharp drop in the stock markets in Japan and the United States reflected the surge in the value of the yen and the dollar, which makes exports from those countries more expensive and imports less expensive. Similarly, while the fall in the pound to levels not seen since the mid-1980s is a worrisome symbol of fears about Britain, it will, at the same time, help cushion the economic blow of leaving the E.U.

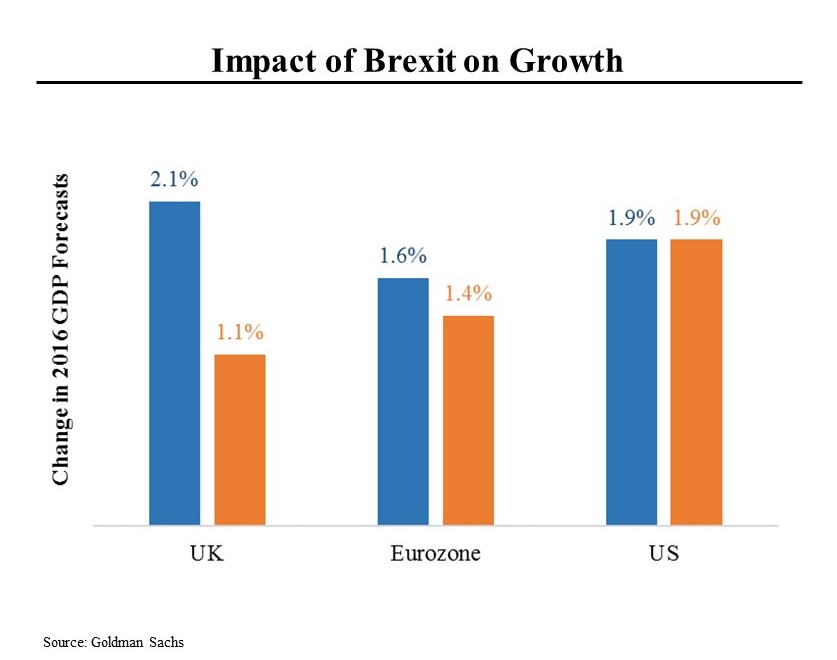

As a result of the vote, economists moved quickly to slash growth forecasts for Britain and the members of the Eurozone common currency block. In the short-run, Britain faces a period of at least three years of significant uncertainty as the terms of its withdrawal are negotiated and implemented. During that period, it is likely that companies will curtain plans to invest in Britain and consumers may refrain from purchases. Some believe Britain could even experience a recession.

That uncertainty will probably affect the Eurozone as well, although to a lesser degree. Although the strong dollar will hurt American exports, the immediate effect of Britain’s decision on the American economy is expected to be muted; economists have not yet reduced their projected 2016 growth forecasts.

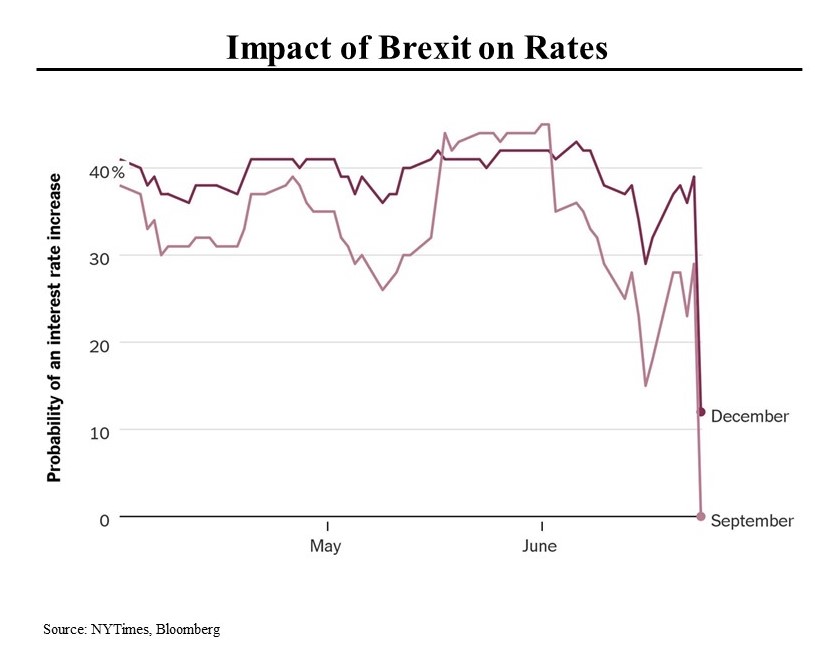

Apart from the dollar and stock prices, the most likely impact of Britain’s decision on the United States may be a postponement of the Federal Reserve’s stated intention to raise interest rates. While right up to the voting results from Britain, financial markets were assigning a significant chance of increases in interest rates in both September and December, the probability of an increase in September is now close to zero and only about 10 percent for December. Lifting rates would make the dollar even stronger, exacerbating the United States’ competitiveness problem.